Credit: tallysolutions.com

Introduction to VAT in UAE

Value Added Tax (VAT) is a tax on consumption. It is levied on most goods and services. The UAE introduced VAT on January 1, 2018. The standard rate is 5%.

Credit: twitter.com

What are Freezone Companies?

Freezone companies operate in designated areas. These areas are called Freezones. Freezones offer business-friendly regulations. They attract foreign investors and entrepreneurs.

VAT Regulations for Freezone Companies

Freezone companies must comply with VAT regulations. Some Freezones are considered Designated Zones. Designated Zones have special VAT rules.

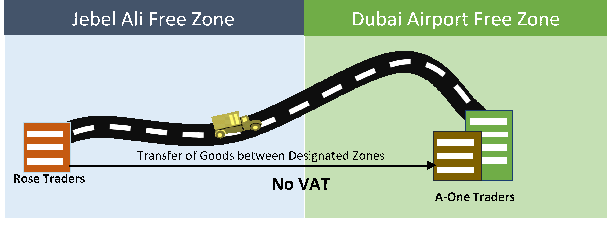

Designated Zones

Designated Zones are VAT-free zones. Transactions within these zones may be VAT-exempt. However, certain conditions must be met.

| Designated Zone | Conditions |

|---|---|

| Jebel Ali Free Zone (JAFZA) | Goods must not leave the zone |

| Dubai Airport Free Zone (DAFZA) | Goods must be exported |

VAT Registration for Freezone Companies

Freezone companies must register for VAT. This applies if their taxable supplies exceed AED 375,000. Voluntary registration is allowed for supplies over AED 187,500.

Steps For Vat Registration

- Create an e-Services account on the Federal Tax Authority (FTA) website.

- Fill in the VAT registration form.

- Submit the required documents.

- Receive your Tax Registration Number (TRN).

VAT Compliance for Freezone Companies

Compliance is crucial for Freezone companies. They must file VAT returns regularly. VAT returns are usually filed quarterly. However, some companies may file monthly.

Steps For Filing Vat Returns

- Log in to your e-Services account.

- Go to the VAT returns section.

- Fill in the return form with accurate details.

- Submit the form before the due date.

- Pay any VAT due.

Penalties for Non-Compliance

Non-compliance can result in penalties. Penalties can be financial or administrative. It is important to adhere to VAT regulations.

- Late registration penalty: AED 20,000

- Late filing penalty: 2% of unpaid VAT

- Incorrect return penalty: Up to 50% of unpaid VAT

Frequently Asked Questions

What Is Vat In Uae Freezone?

VAT is a 5% tax on goods and services.

Are Freezone Companies Vat Exempt?

No, Freezone companies must register and pay VAT.

How To Register For Vat In Uae?

Register online via the Federal Tax Authority (FTA) website.

Do Freezone Companies Charge Vat?

Yes, they charge VAT on taxable supplies.

Conclusion

Understanding VAT is crucial for Freezone companies in the UAE. Compliance helps avoid penalties. Proper registration and timely filings are essential. Always stay updated with the latest regulations.

Ahmed bin Rashid, a seasoned travel enthusiast and visa process expert and the successful Businessman in Dubai. With an LLB from the University of Bolton in 2015, he combines his legal knowledge with his passion for exploration, offering invaluable insights into Business formation and visa processes around the globe. Follow Ahmed’s captivating journeys and expert advice to embark on your unforgettable adventures & Business.