Preparing a VAT return in the UAE can seem like a big task. But don’t worry, this guide will help you through it. You’ll learn each step, find tips, and understand important details about VAT in the UAE.

Understanding VAT in the UAE

VAT stands for Value Added Tax. It is a tax on goods and services. In the UAE, VAT was introduced on January 1, 2018. The standard VAT rate is 5%.

Who Needs To File A Vat Return?

If your business is registered for VAT, you need to file a VAT return. This applies even if you have no VAT to pay or reclaim.

When To File A Vat Return?

VAT returns are usually filed quarterly. This means every three months. The due date is the 28th day of the month following the end of the tax period. For example, if your tax period ends in March, your VAT return is due by April 28.

Credit: tallysolutions.com

Steps to Prepare a VAT Return

1. Gather All Necessary Documents

First, collect all your invoices and receipts. You need both sales and purchase invoices. This will help you calculate your VAT accurately.

2. Calculate Your Sales And Purchases

Add up the total amount of sales and purchases. Make sure you include VAT in your calculations. This will give you the total VAT collected and paid.

3. Determine Your Vat Payable Or Refundable

To determine this, subtract the total VAT paid on purchases from the total VAT collected on sales. The result will show if you owe VAT or if you will get a refund.

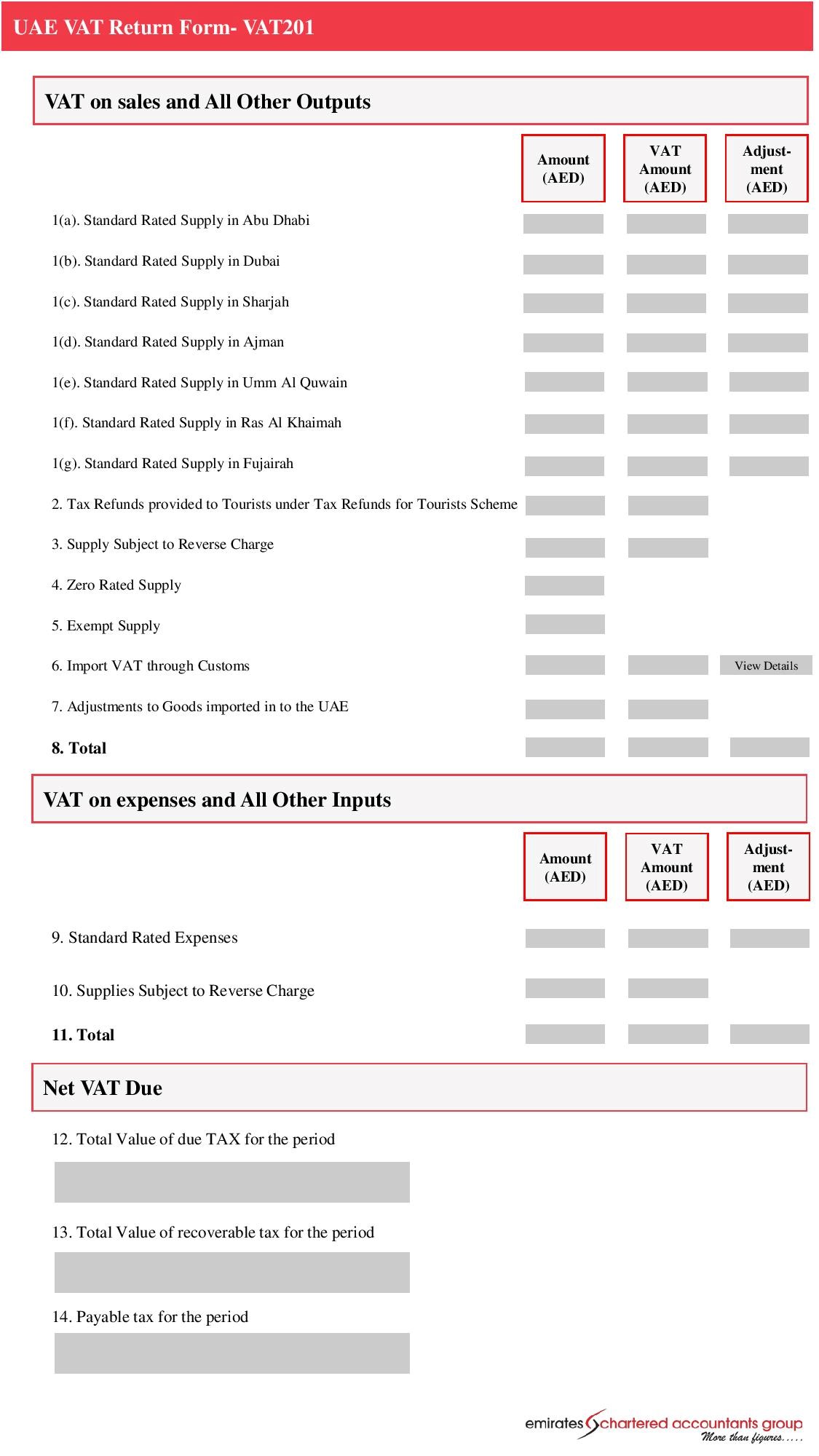

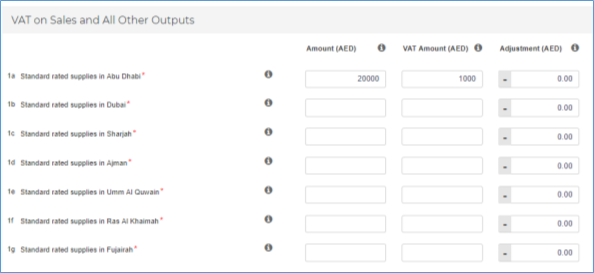

4. Fill Out The Vat Return Form

Log in to the Federal Tax Authority (FTA) portal. Fill in the VAT return form with the correct details. Ensure all information is accurate.

5. Submit The Vat Return

Once the form is complete, submit it through the FTA portal. Keep a copy for your records. This will help if you need to refer to it later.

6. Pay Any Due Vat

If you owe VAT, pay it by the due date. You can make the payment through the FTA portal. Late payments may result in penalties.

Important Tips for VAT Return Preparation

- Keep all your records organized. This makes it easier to find what you need.

- Double-check your calculations to avoid mistakes.

- Submit your VAT return on time to avoid penalties.

- Seek help from a tax professional if you are unsure about anything.

Common VAT Return Mistakes to Avoid

- Not keeping proper records of transactions.

- Incorrectly calculating VAT.

- Missing the submission deadline.

- Failing to pay due VAT on time.

Credit: m.youtube.com

Frequently Asked Questions

What Is A Vat Return In Uae?

A VAT return in UAE is a document showing VAT collected and paid by businesses.

Who Needs To File Vat Return?

Businesses registered under VAT in UAE must file VAT returns regularly.

How Often To File Vat Returns?

VAT returns are typically filed quarterly, but some businesses may file monthly.

What Is The Vat Return Deadline?

The deadline to file VAT returns is 28 days after the tax period ends.

Conclusion

Preparing a VAT return in the UAE doesn’t have to be hard. Follow these steps, stay organized, and you will manage it well. Remember, if in doubt, seek professional help. This ensures that your VAT return is accurate and timely.

Useful Links

Ahmed bin Rashid, a seasoned travel enthusiast and visa process expert and the successful Businessman in Dubai. With an LLB from the University of Bolton in 2015, he combines his legal knowledge with his passion for exploration, offering invaluable insights into Business formation and visa processes around the globe. Follow Ahmed’s captivating journeys and expert advice to embark on your unforgettable adventures & Business.