The United Arab Emirates (UAE) is known for its thriving business environment. Many businesses are attracted to UAE free zones. Free zones offer various benefits, including tax incentives. But, is VAT applicable in UAE free zones? Let’s dive deep and understand VAT rules in these areas.

Credit: tallysolutions.com

What are UAE Free Zones?

Free zones are special economic areas. They offer businesses full ownership, tax benefits, and simplified import and export procedures. Free zones aim to attract foreign investment and boost economic growth. There are many free zones in the UAE, each catering to different industries.

Introduction to VAT in the UAE

Value Added Tax (VAT) was introduced in the UAE on January 1, 2018. VAT is a consumption tax applied to goods and services. The standard VAT rate in the UAE is 5%. VAT aims to diversify the economy and reduce dependence on oil revenues.

VAT Applicability in UAE Free Zones

Now, let’s address the main question: Is VAT applicable in UAE free zones? The answer is yes, but with some exceptions. The UAE has designated certain free zones as “Designated Zones.” Different VAT rules apply to these designated zones.

Designated Zones In The Uae

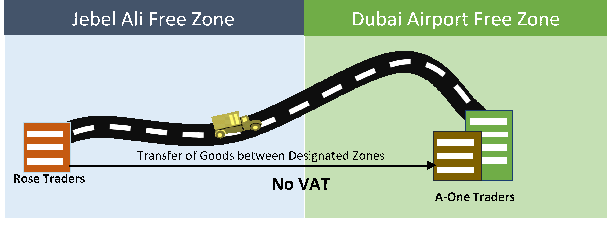

Designated Zones are specific areas within free zones. They are treated as being outside the UAE for VAT purposes. Transactions within these zones may be VAT-free. However, not all free zones are designated zones.

Here are some examples of designated zones:

| Free Zone | Designated Zone |

|---|---|

| Jebel Ali Free Zone (JAFZA) | Yes |

| Dubai Airport Free Zone (DAFZA) | Yes |

| Abu Dhabi Airport Free Zone (ADAFZ) | Yes |

| Dubai Silicon Oasis (DSO) | No |

Vat Treatment In Designated Zones

In designated zones, certain transactions are VAT-exempt. For example, goods supplied within a designated zone are not subject to VAT. However, services provided within a designated zone are subject to VAT. It’s important to understand the specific rules for each designated zone.

Goods Transactions in Designated Zones

Goods can move freely within a designated zone without VAT. If goods are moved from a designated zone to the mainland, VAT applies. Importing goods into a designated zone is VAT-free. Exporting goods from a designated zone is also VAT-free.

Services Transactions in Designated Zones

Services provided within a designated zone are subject to VAT. This includes services like consulting, marketing, and legal services. Businesses must charge 5% VAT on these services. They must also file regular VAT returns to the Federal Tax Authority (FTA).

VAT Compliance for Businesses in Free Zones

Businesses in free zones must comply with VAT regulations. This includes registering for VAT if their taxable supplies exceed AED 375,000. They must also keep detailed records of transactions. These records help in filing accurate VAT returns.

Vat Registration

Businesses with taxable supplies over AED 375,000 must register for VAT. They can register online through the FTA portal. Once registered, they receive a Tax Registration Number (TRN).

Vat Returns

VAT-registered businesses must file regular VAT returns. They must submit returns every quarter. The returns include details of sales, purchases, and VAT collected. The deadline for filing VAT returns is the 28th of the month following the end of the tax period.

Record Keeping

Businesses must keep detailed records of all transactions. This includes sales invoices, purchase invoices, and import/export documents. These records must be kept for at least five years.

Credit: www.linkedin.com

Common VAT Mistakes to Avoid

Many businesses make mistakes when dealing with VAT. Here are some common VAT mistakes to avoid:

- Failing to register for VAT on time

- Incorrectly applying VAT rates

- Not keeping detailed records

- Missing VAT return deadlines

- Not understanding VAT rules for designated zones

Frequently Asked Questions

Is Vat Applicable In Uae Free Zones?

Yes, VAT is applicable in some UAE Free Zones.

What Are Uae Free Zones?

UAE Free Zones are special economic areas with tax incentives.

Which Free Zones Are Vat Exempt?

Designated Zones are VAT exempt in the UAE.

How To Determine Vat In Free Zones?

Consult UAE Federal Tax Authority guidelines.

Conclusion

VAT is applicable in UAE free zones, but with exceptions. Designated zones have special VAT rules. Businesses in free zones must comply with VAT regulations. This includes registering for VAT, filing returns, and keeping records. Understanding VAT rules helps businesses avoid penalties and stay compliant.

Do you have more questions about VAT in UAE free zones? Feel free to reach out to a tax expert or consult the Federal Tax Authority (FTA) website. Staying informed and compliant is key to business success in the UAE.

Ahmed bin Rashid, a seasoned travel enthusiast and visa process expert and the successful Businessman in Dubai. With an LLB from the University of Bolton in 2015, he combines his legal knowledge with his passion for exploration, offering invaluable insights into Business formation and visa processes around the globe. Follow Ahmed’s captivating journeys and expert advice to embark on your unforgettable adventures & Business.