Credit: www.linkedin.com

Introduction

Becoming a tax agent in UAE is a rewarding career. Tax agents help businesses comply with tax laws. They also offer valuable advice on tax matters.

What is a Tax Agent?

A tax agent is a professional. They assist businesses with tax compliance. They also help with tax planning and filing returns.

Credit: www.indeed.com

Why Become a Tax Agent in UAE?

- High demand for tax experts

- Competitive salary

- Opportunity to help businesses

- Career growth

Steps to Become a Tax Agent in UAE

1. Educational Requirements

First, you need a degree. A degree in accounting, finance, or law is preferred.

2. Gain Relevant Experience

Experience is crucial. Work in accounting or finance for at least three years.

3. Get Certified

You need a certification. The Federal Tax Authority (FTA) offers certification.

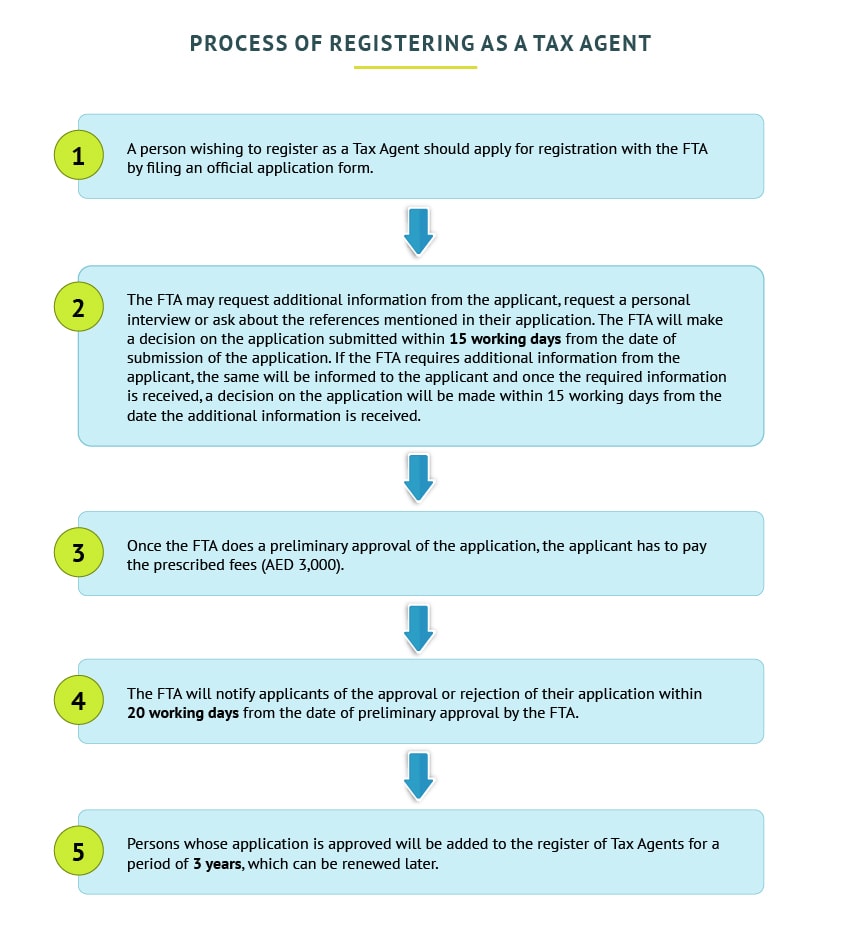

4. Register With The Fta

Register as a tax agent with the FTA. This step is mandatory.

5. Continuous Education

Keep learning. Attend workshops and courses regularly.

Requirements for FTA Certification

| Requirement | Description |

|---|---|

| Education | Relevant degree in finance, accounting, or law |

| Experience | At least three years in accounting or finance |

| Exam | Pass the FTA certification exam |

| Registration | Register with the FTA |

Benefits of Being a Certified Tax Agent

- Recognized professional status

- Increased job opportunities

- Higher earning potential

- Ability to help businesses

Challenges of Being a Tax Agent

- Keeping up with tax laws

- Managing client expectations

- Continuous education requirements

- High responsibility

Frequently Asked Questions

How To Register As A Tax Agent In Uae?

To register, apply through the Federal Tax Authority (FTA) website and meet all eligibility criteria.

What Are The Eligibility Criteria?

You must have a bachelor’s degree in finance, tax, or law, and relevant work experience.

How Long Does The Registration Process Take?

The registration process typically takes around 15 working days.

Do I Need Specific Qualifications?

Yes, a bachelor’s degree in finance, accounting, tax, or law is required.

Conclusion

Becoming a tax agent in UAE is a fulfilling career. It requires education, experience, and certification. The benefits outweigh the challenges. This guide provides a clear path to becoming a tax agent. Start your journey today!

Ahmed bin Rashid, a seasoned travel enthusiast and visa process expert and the successful Businessman in Dubai. With an LLB from the University of Bolton in 2015, he combines his legal knowledge with his passion for exploration, offering invaluable insights into Business formation and visa processes around the globe. Follow Ahmed’s captivating journeys and expert advice to embark on your unforgettable adventures & Business.