Creating a tax invoice in the UAE is very important. It is required by law if you are VAT registered. This guide will help you make a proper tax invoice. Follow these steps to make sure you do it right.

What is a Tax Invoice?

A tax invoice is a document. It shows details of a sale. It includes the amount of VAT. Businesses in the UAE must issue tax invoices. This is because of VAT regulations.

Why is a Tax Invoice Important?

Tax invoices are important for many reasons:

- They help track sales and purchases.

- They are needed for VAT reporting.

- They are proof of transactions.

Credit: tallysolutions.com

Components of a Tax Invoice

To create a tax invoice, you need to include specific information. Here are the main components:

1. Seller Information

Include the name, address, and VAT number of the seller.

2. Buyer Information

Include the name and address of the buyer.

3. Invoice Number

Each tax invoice must have a unique number. This helps with record-keeping.

4. Date Of Issue

Include the date when the invoice is issued.

5. Description Of Goods Or Services

Provide a detailed description of the goods or services sold.

6. Quantity And Unit Price

Show the quantity and unit price of each item.

7. Total Amount

Calculate the total amount for all items. This includes VAT.

8. Vat Amount

Clearly show the VAT amount for each item. Also, show the total VAT amount.

| Component | Description |

|---|---|

| Seller Information | Name, address, and VAT number of the seller. |

| Buyer Information | Name and address of the buyer. |

| Invoice Number | Unique number for each invoice. |

| Date of Issue | Date when the invoice is issued. |

| Description of Goods or Services | Detailed description of the goods or services sold. |

| Quantity and Unit Price | Quantity and unit price of each item. |

| Total Amount | Total amount for all items, including VAT. |

| VAT Amount | VAT amount for each item and the total VAT amount. |

Steps to Create a Tax Invoice

Follow these steps to create a tax invoice:

Step 1: Gather Information

Collect all necessary information. This includes seller and buyer details, and transaction details.

Step 2: Use A Template

Use a tax invoice template. This ensures you include all required information.

Step 3: Fill In The Details

Fill in the seller and buyer information. Include the invoice number and date of issue.

Step 4: Describe The Goods Or Services

Provide a detailed description of the goods or services sold. Include the quantity and unit price.

Step 5: Calculate The Total Amount

Calculate the total amount for all items. Ensure you include VAT.

Step 6: Show The Vat Amount

Clearly show the VAT amount for each item and the total VAT amount.

Step 7: Review And Issue

Review the invoice to make sure everything is correct. Then, issue the invoice to the buyer.

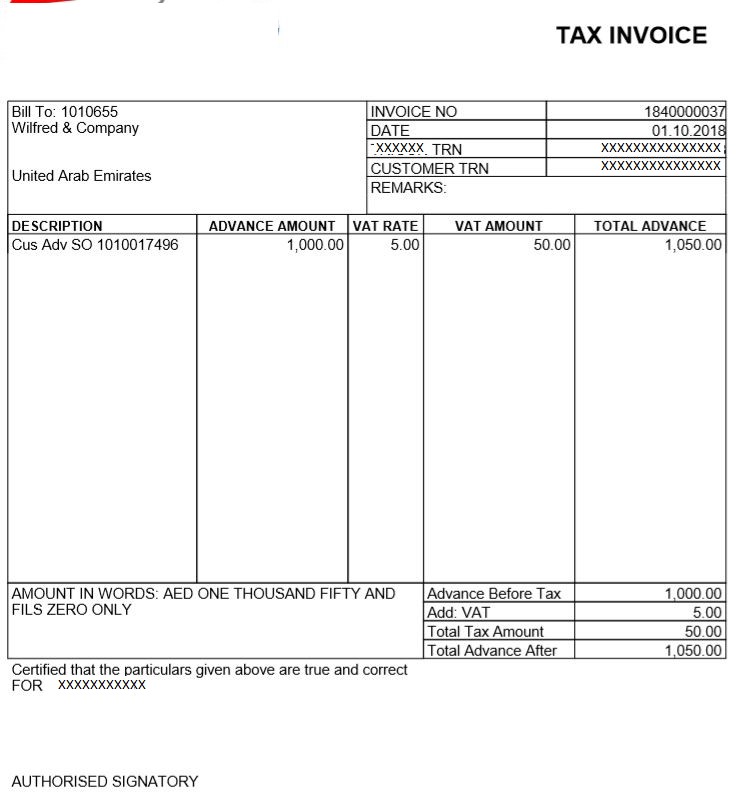

Example of a Tax Invoice

Here is an example of a tax invoice:

| Tax Invoice | |

|---|---|

| Seller Information | ABC Trading LLC, Dubai, VAT No: 123456789 |

| Buyer Information | XYZ Corp, Sharjah |

| Invoice Number | INV-001 |

| Date of Issue | 01-Jan-2023 |

| Description of Goods | Office Chairs |

| Quantity | 10 |

| Unit Price | 100 AED |

| Total Amount | 1000 AED |

| VAT Amount | 50 AED (5% VAT) |

| Grand Total | 1050 AED |

Credit: www.penieltech.com

Tips for Creating a Tax Invoice

Here are some tips for creating a tax invoice:

- Always double-check the information.

- Use a consistent format.

- Keep a copy of each invoice for your records.

- Ensure the invoice is clear and easy to read.

Common Mistakes to Avoid

Here are some common mistakes to avoid when creating a tax invoice:

- Missing information.

- Incorrect VAT calculations.

- Using an incorrect invoice number.

- Not keeping copies of invoices.

Frequently Asked Questions

What Is A Tax Invoice In Uae?

A tax invoice is a document issued by a VAT-registered business in UAE for taxable goods or services.

Who Should Issue A Tax Invoice?

VAT-registered businesses in UAE must issue a tax invoice for taxable supplies exceeding AED 1,000.

What Details Are Required On A Tax Invoice?

A tax invoice must include supplier details, VAT registration number, invoice date, and itemized list of goods/services.

Can I Issue An Electronic Tax Invoice?

Yes, electronic tax invoices are allowed in UAE, provided they meet FTA requirements.

Conclusion

Making a tax invoice in the UAE is easy if you follow the steps. Ensure you include all necessary information. Double-check everything to avoid mistakes. Use a template to help you. Remember to keep a copy of each invoice. This will help with your records and VAT reporting.

Ahmed bin Rashid, a seasoned travel enthusiast and visa process expert and the successful Businessman in Dubai. With an LLB from the University of Bolton in 2015, he combines his legal knowledge with his passion for exploration, offering invaluable insights into Business formation and visa processes around the globe. Follow Ahmed’s captivating journeys and expert advice to embark on your unforgettable adventures & Business.