Understanding How Credit Card Interest is Calculated in UAE

Credit cards have become an integral part of our financial lives, offering convenience and flexibility for making purchases and managing expenses. However, it’s crucial to have a clear understanding of how credit card interest is calculated in the UAE to avoid falling into a cycle of debt. In this comprehensive guide, we’ll delve into the intricacies of credit card interest calculation, shedding light on the various factors that influence the amount of interest you may accrue. Whether you’re a seasoned credit card user or a newcomer to the world of plastic money, this article aims to demystify the concept of credit card interest and empower you to make informed financial decisions.

Factors Affecting Credit Card Interest Calculation

Before delving into the specifics of how credit card interest is calculated, it’s essential to grasp the factors that influence this process. In the UAE, credit card interest calculation is influenced by several key elements, including the annual percentage rate (APR), the outstanding balance, and the billing cycle. Let’s explore each of these factors in detail:

Annual Percentage Rate (APR): The APR represents the annual cost of borrowing on a credit card, expressed as a percentage. In the UAE, credit card issuers typically disclose the monthly interest rate, which can be converted to an annual percentage by multiplying it by 12. The APR serves as the baseline for calculating interest on outstanding balances, and it’s essential to pay close attention to this figure when comparing credit card offers.

Outstanding Balance: The outstanding balance on your credit card refers to the amount of money you owe to the card issuer. This balance is a key determinant of the interest you will be charged, as the interest is typically calculated based on the outstanding balance at the end of each billing cycle. It’s important to manage your outstanding balance responsibly to minimize the interest costs associated with your credit card usage.

Billing Cycle: The billing cycle, also known as the statement period, refers to the duration for which your credit card transactions are compiled to generate a monthly statement. Understanding your billing cycle is crucial, as it impacts the timing of interest calculations and payment due dates. By staying informed about your billing cycle, you can effectively manage your credit card payments and minimize interest charges.

Methods of Credit Card Interest Calculation

In the UAE, credit card issuers employ various methods to calculate interest on outstanding balances. The two primary methods used for credit card interest calculation are the average daily balance method and the two-cycle average daily balance method. Let’s take a closer look at each of these methods:

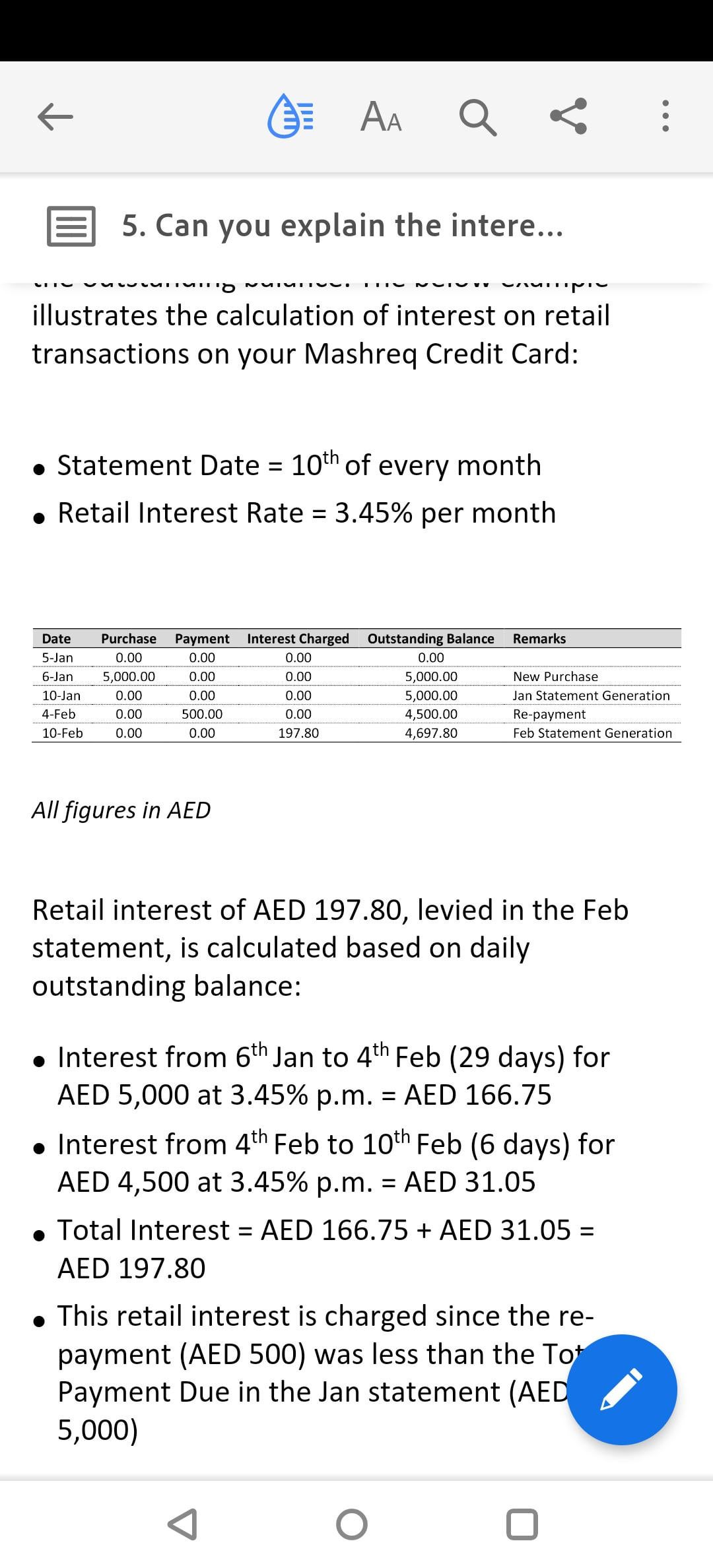

Average Daily Balance Method: Under this method, the credit card issuer calculates the average daily balance for the billing cycle by summing up the daily balances and dividing the total by the number of days in the cycle. The interest is then calculated based on this average daily balance. This method offers transparency and predictability, as the interest is calculated based on the average amount owed over the billing cycle.

Two-Cycle Average Daily Balance Method: In contrast to the average daily balance method, the two-cycle average daily balance method takes into account the average daily balances from the current and previous billing cycles. This method can result in higher interest charges, especially if you carry a balance from the previous month. It’s important to be aware of the interest calculation method used by your credit card issuer to understand how your interest charges are being computed.

Understanding Grace Periods and Interest-Free Periods

In the realm of credit card usage, grace periods and interest-free periods play a pivotal role in managing interest costs and optimizing your financial resources. Let’s explore the concepts of grace periods and interest-free periods to gain a comprehensive understanding of their impact on credit card interest calculation:

Grace Periods: A grace period refers to the timeframe during which you can pay off your credit card balance without incurring any interest charges. In the UAE, credit card issuers typically offer a grace period of around 20 to 25 days from the statement date, allowing cardholders to settle their balances without accruing interest. By taking advantage of the grace period and paying off the full outstanding balance within this timeframe, you can avoid interest charges altogether.

Interest-Free Periods: Some credit cards in the UAE offer promotional interest-free periods on specific types of transactions, such as purchases or balance transfers. During these promotional periods, cardholders can make transactions within the specified category without being subject to interest charges for a predetermined duration. It’s important to be mindful of the terms and conditions associated with interest-free periods to leverage these benefits effectively.

Tips for Managing Credit Card Interest Costs

Effectively managing credit card interest costs is essential for maintaining financial stability and avoiding excessive debt. Here are some valuable tips to help you navigate the realm of credit card interest and minimize the impact on your financial well-being:

1. Pay Off the Full Balance: Whenever possible, strive to pay off the full outstanding balance on your credit card within the grace period to avoid accruing interest. By making timely and complete payments, you can steer clear of interest charges and maintain a healthy financial standing.

2. Monitor Your Spending: Keeping a close eye on your credit card expenditures can help you avoid accumulating a high outstanding balance. By practicing mindful spending and budgeting, you can mitigate the risk of incurring substantial interest charges.

3. Understand the Terms and Conditions: Familiarize yourself with the terms and conditions of your credit card agreement, including the APR, billing cycle, and interest calculation method. Being well-informed about these aspects can empower you to make informed decisions and optimize your credit card usage.

4. Consider Balance Transfers: If you have outstanding balances on high-interest credit cards, exploring balance transfer options to a card with a lower promotional interest rate can help reduce your interest costs. However, it’s crucial to assess the associated fees and the post-promotional interest rates before opting for a balance transfer.

5. Avoid Cash Advances: Cash advances on credit cards often attract higher interest rates and additional fees. Whenever possible, refrain from using your credit card for cash advances to minimize interest costs and fees.

By leveraging these tips and insights, you can navigate the landscape of credit card interest calculation with confidence and prudence, ensuring that your financial journey remains on a steady and sustainable course.

In Conclusion

Understanding how credit card interest is calculated in the UAE is a vital aspect of managing your financial resources effectively. By familiarizing yourself with the factors that influence interest calculation, the methods used by credit card issuers, and the concepts of grace periods and interest-free periods, you can make informed decisions to minimize interest costs and optimize your credit card usage. With a mindful approach to managing your credit card balances and transactions, you can harness the benefits of credit cards while safeguarding your financial well-being.

Ahmed bin Rashid, a seasoned travel enthusiast and visa process expert and the successful Businessman in Dubai. With an LLB from the University of Bolton in 2015, he combines his legal knowledge with his passion for exploration, offering invaluable insights into Business formation and visa processes around the globe. Follow Ahmed’s captivating journeys and expert advice to embark on your unforgettable adventures & Business.