Emirates NBD is one of the leading banks in the United Arab Emirates, providing a wide range of banking and financial services to its customers. One of the essential processes for account holders is to keep their Know Your Customer (KYC) information updated. In this blog post, we will discuss the importance of updating KYC information, the steps involved in updating KYC with Emirates NBD, and some useful tips to ensure a smooth and hassle-free process.

### Importance of Updating KYC Information

KYC is a vital process that helps banks and financial institutions verify the identity of their customers. It is a regulatory requirement aimed at preventing money laundering, fraud, and other financial crimes. By keeping your KYC information updated, you not only comply with regulatory requirements but also help the bank maintain accurate and up-to-date records.

Failure to update your KYC information may result in restrictions on your account, such as limitations on transactions or account closures. Therefore, it is crucial to ensure that your KYC details are current and accurate to avoid any inconvenience in the future.

### Steps to Update KYC with Emirates NBD

Updating your KYC information with Emirates NBD is a straightforward process, and the bank provides multiple channels for customers to complete this requirement. Here are the general steps to update your KYC information:

1.

Visit the Nearest Branch: You can visit any Emirates NBD branch to update your KYC information. Simply approach the customer service desk or the designated KYC update counter, and a bank representative will assist you with the necessary forms and documentation.

2.

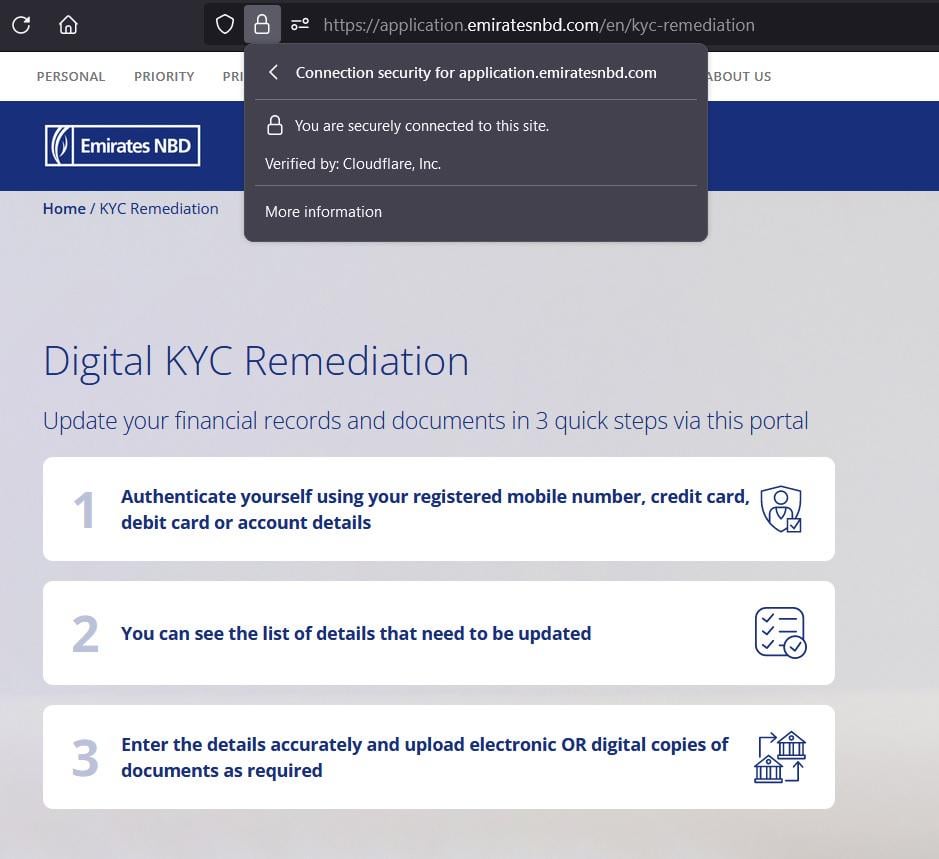

Online Banking: Emirates NBD also offers the convenience of updating KYC information through its online banking platform. Log in to your online banking account, navigate to the KYC update section, and follow the instructions provided to submit the required details and documents.

3.

Mobile Banking App: For tech-savvy customers, the Emirates NBD mobile banking app provides a seamless option to update KYC information. Simply access the app, locate the KYC update feature, and follow the prompts to complete the process from the comfort of your smartphone.

4.

Customer Service: If you have any queries or require assistance with updating your KYC information, you can contact Emirates NBD customer service via phone or email. The customer service representatives will guide you through the process and address any concerns you may have.

### Documents Required for KYC Update

When updating your KYC information with Emirates NBD, you will need to provide certain documents to verify your identity and address. The specific documents may vary based on your customer profile and the nature of the updates required. However, the typical documents required for KYC update include:

–

Valid Passport: A copy of your valid passport for identity verification.

–

Emirates ID: A copy of your Emirates ID card for residents of the UAE.

–

Proof of Address: Documents such as utility bills or a tenancy contract to verify your current address.

–

Income Proof: In some cases, you may need to provide income-related documents, such as salary slips or bank statements.

It’s important to check with the bank regarding the specific documents needed for your KYC update to ensure a smooth and efficient process.

### Tips for a Smooth KYC Update Process

To make the KYC update process with Emirates NBD as seamless as possible, consider the following tips:

1.

Prepare the Required Documents: Before visiting the bank or accessing online banking, ensure that you have all the necessary documents readily available. This includes copies of your passport, Emirates ID, proof of address, and any other relevant documents based on your specific update requirements.

2.

Follow Instructions Carefully: Whether updating your KYC information in person or through digital channels, carefully follow the instructions provided by Emirates NBD. Pay attention to the details required and ensure that all information is accurately provided to avoid any delays in the process.

3.

Reach Out for Assistance: If you encounter any difficulties or have questions about the KYC update process, don’t hesitate to reach out to Emirates NBD customer service. The bank’s representatives are there to assist you and can provide clarification on any aspect of the process.

4.

Stay Informed about Deadlines: In case there are specific deadlines for updating your KYC information, such as regulatory compliance timelines, stay informed and take proactive steps to meet the requirements within the stipulated time frame.

5.

Double-Check Information: Before submitting your updated KYC details, double-check all the information provided to ensure accuracy. This includes verifying the spellings of your name, address details, and other personal information.

### Conclusion

Keeping your KYC information updated with Emirates NBD is an important responsibility for all account holders. By understanding the significance of KYC compliance, familiarizing yourself with the steps involved, and preparing the necessary documents, you can ensure a smooth and efficient KYC update process. Remember to leverage the available channels, such as visiting a branch, using online banking, or accessing the mobile banking app, to conveniently update your KYC information. By following the tips provided and staying proactive, you can maintain compliance with regulatory requirements and enjoy uninterrupted banking services with Emirates NBD.

Ahmed bin Rashid, a seasoned travel enthusiast and visa process expert and the successful Businessman in Dubai. With an LLB from the University of Bolton in 2015, he combines his legal knowledge with his passion for exploration, offering invaluable insights into Business formation and visa processes around the globe. Follow Ahmed’s captivating journeys and expert advice to embark on your unforgettable adventures & Business.