The minimum earning threshold for a credit card in the UAE typically starts at AED 5,000 monthly. This requirement varies based on the bank and the specific credit card type.

In the UAE, obtaining a credit card requires meeting certain income criteria, which banks use to assess eligibility. The minimum salary threshold often begins at AED 5,000, but some banks may have higher or lower limits depending on the card’s features and benefits.

Understanding these requirements is crucial for anyone looking to apply for a credit card. Banks evaluate not just the salary, but also credit history, employment stability, and other financial factors. By knowing the minimum earning threshold, potential cardholders can better prepare their applications and improve their chances of approval.

Introduction To Uae Credit Card Earnings Threshold

The UAE has a structured system for credit card eligibility. One crucial factor is the earnings threshold. This threshold determines who qualifies for a credit card. Understanding this can help applicants make informed choices.

The Importance Of Earnings Threshold

The earnings threshold plays a vital role in credit card applications. Here are some key points:

- Financial Security: Banks assess income levels to ensure applicants can repay debts.

- Risk Assessment: Higher earnings often mean lower risk for banks.

- Credit Limits: Earnings affect the credit limit offered to the cardholder.

Many banks in the UAE set a minimum salary requirement. This requirement varies based on the bank and card type.

Credit Card Eligibility Basics

Eligibility for a credit card in the UAE depends on several factors:

| Factor | Details |

|---|---|

| Minimum Salary | Most banks require a salary of at least AED 5,000. |

| Age Requirement | Applicants must be at least 21 years old. |

| Employment Status | Full-time employment is preferred. |

| Credit Score | A good credit score increases approval chances. |

Applicants should gather necessary documents before applying. This includes:

- Copy of passport and residence visa

- Salary certificate or pay slips

- Bank statements for the last three months

Understanding these basics helps applicants prepare better for the credit card process.

Historical Perspective Of Minimum Earnings

The minimum earning threshold for credit cards in the UAE has changed significantly over the years. Understanding this evolution helps consumers navigate their financial options. The policies reflect the economic climate and banking regulations in the region. Let’s explore the key developments in credit card policies.

Evolution Of Credit Card Policies

Credit card policies in the UAE have evolved due to various factors. Initially, the minimum salary requirement was quite low. Over time, banks raised these thresholds to mitigate risk and improve financial health.

- 1990s: Minimum salary requirements were around AED 3,000.

- 2000s: Increased to AED 5,000 for basic cards.

- 2010s: Premium cards required salaries above AED 10,000.

- 2020s: Some banks now require AED 15,000 or more for elite cards.

This trend shows a move towards stricter lending standards. Banks aim to ensure that cardholders can manage debt effectively.

Comparative Analysis Over The Years

| Year | Minimum Salary (AED) | Card Type |

|---|---|---|

| 1990s | 3,000 | Basic |

| 2000s | 5,000 | Standard |

| 2010s | 10,000 | Premium |

| 2020s | 15,000+ | Elite |

The analysis shows a clear increase in minimum salary requirements. This shift reflects the growing demand for responsible lending. Higher income levels help banks reduce default risks.

As the UAE economy continues to grow, these thresholds may change further. Keeping an eye on these developments is crucial for potential credit card users.

Current Earnings Thresholds In The Uae

Understanding the current earnings thresholds for credit cards in the UAE is crucial. Many banks set minimum salary requirements. These requirements determine eligibility for various credit cards. Knowing these thresholds helps potential applicants make informed decisions.

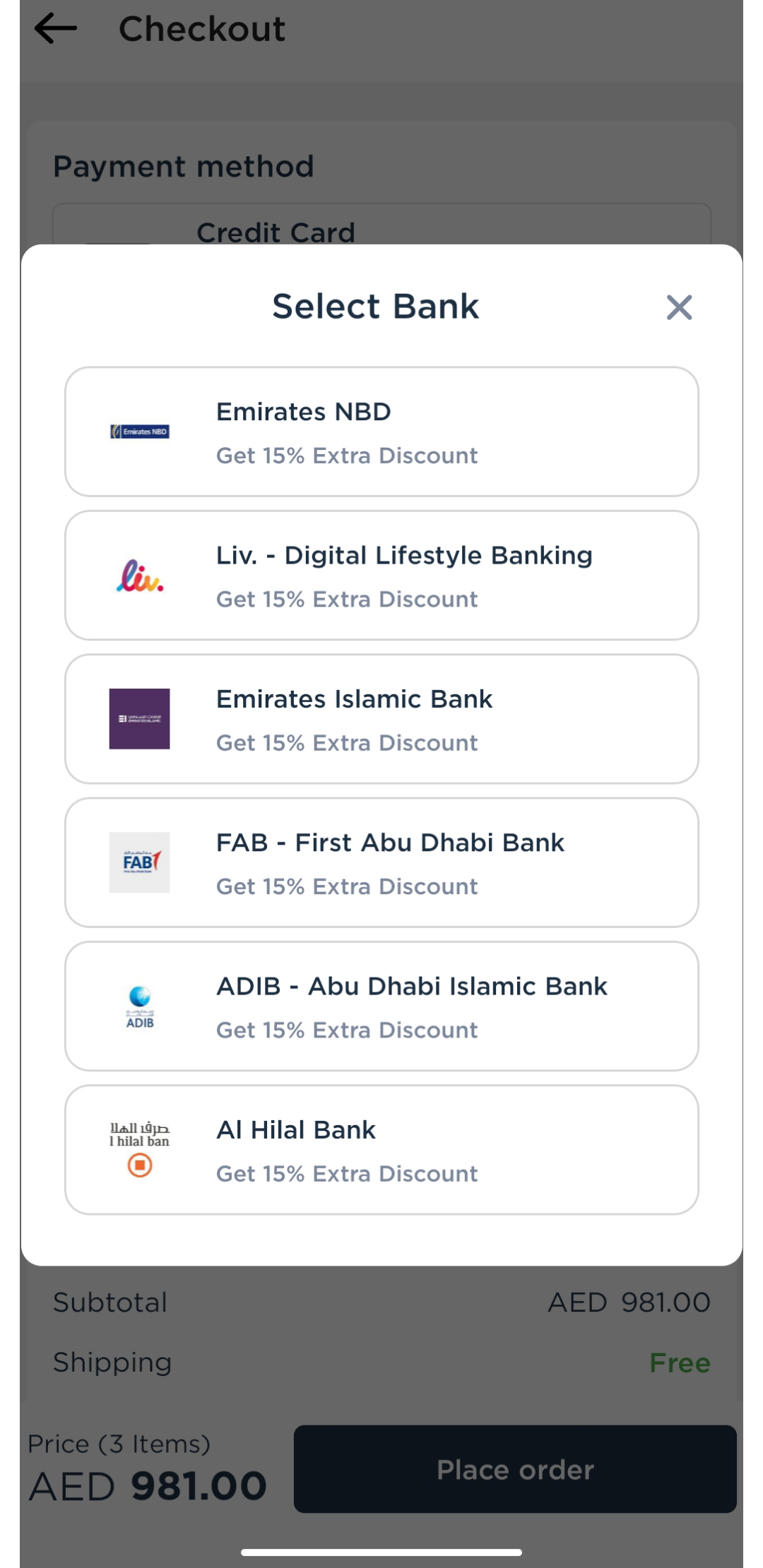

Bank-specific Minimums

Different banks in the UAE have varying minimum earning thresholds for credit card applications. Below is a table showcasing some of the most common banks and their respective salary requirements:

| Bank Name | Minimum Salary (AED) |

|---|---|

| Emirates NBD | 5,000 |

| FAB | 7,000 |

| ADCB | 8,000 |

| RAK Bank | 4,000 |

| Dubai Islamic Bank | 5,000 |

Some banks offer specific credit cards for lower earning thresholds. This helps more individuals access credit facilities.

Recent Changes And Updates

The UAE banking sector frequently updates its policies. Recent changes have affected minimum salary requirements for credit cards.

- Some banks reduced their thresholds to attract more customers.

- New credit card products introduced with flexible earning requirements.

- Increased competition among banks led to better offers for applicants.

Staying informed about these changes is essential. Regularly check with your bank for the latest updates on their credit card eligibility criteria.

Credit: www.reddit.com

Factors Influencing Earnings Thresholds

Understanding the minimum earning thresholds for credit cards in the UAE is crucial. Various factors impact these thresholds. They can determine whether you qualify for a card. Knowing these factors can help you make informed financial decisions.

Credit Score Implications

Your credit score plays a vital role in credit card eligibility. A higher score often leads to better terms. Banks view a high score as a sign of responsible borrowing.

- A score above 700 is generally favorable.

- A score below 600 may limit your options.

Credit scores are influenced by:

- Payment history

- Credit utilization ratio

- Length of credit history

Regularly checking your credit score can help you maintain or improve it.

Income Stability And Employment Type

Your income stability affects your earning threshold. Banks prefer steady income sources. Employment type also matters. Salaried individuals often have an easier time qualifying.

| Employment Type | Impact on Threshold |

|---|---|

| Salaried | Higher chances of meeting earning thresholds |

| Self-employed | May require higher income proof |

| Freelancers | Need consistent earnings to qualify |

Stability in your job can significantly affect your credit options.

Impact On Consumers And The Market

The minimum earning threshold for credit cards in the UAE significantly shapes consumer behavior. It also influences the credit card market dynamics. Understanding these effects is crucial for consumers and businesses alike.

Consumer Spending Behavior

The minimum salary requirement impacts how consumers manage their finances. Here are some key points:

- Increased Spending: Higher credit limits encourage consumers to spend more.

- Budgeting Challenges: Consumers may struggle to stay within their budgets.

- Debt Risks: Easier access to credit can lead to increased debt.

Many consumers adapt their spending habits based on these thresholds. Some prefer to use credit cards for rewards and cashback. Others may limit their use to avoid debt.

Here’s a table illustrating consumer spending habits:

| Spending Category | Percentage of Users |

|---|---|

| Essentials | 40% |

| Lifestyle | 30% |

| Travel | 15% |

| Investments | 10% |

Credit Card Market Dynamics

The minimum earning threshold drives competition among banks. Here are some observed trends:

- Product Variety: Banks offer various credit cards to attract consumers.

- Promotional Offers: Incentives like cashback and rewards increase.

- Interest Rates: Banks adjust rates to manage risk.

As the market evolves, consumer preferences change. Some consumers seek cards with lower thresholds. Others prefer premium cards with higher limits.

This shift influences how banks design their products. Enhanced customer service and flexible repayment options become essential.

Credit: www.khaleejuae.com

Comparing Credit Cards Across Banks

Choosing the right credit card in the UAE can be challenging. Different banks offer various options. Each card has its own minimum earning threshold. Understanding these differences helps in making informed decisions. Let’s explore credit cards across banks.

Low Salary Credit Card Options

Many banks provide credit cards for individuals with low salaries. These cards are accessible for those earning less than the typical threshold. Here are a few options:

- Emirates NBD Liv. Card: Minimum salary requirement is AED 3,000.

- RAK Bank Fast Saver Card: Requires a minimum salary of AED 5,000.

- FAB Zero Balance Credit Card: Suitable for salaries starting at AED 5,000.

These options allow more people to access credit cards. They often come with fewer benefits but can still be useful.

Premium Cards And High Earnings Requirement

Premium credit cards usually require higher salaries. These cards offer better rewards and benefits. Here’s a quick overview:

| Bank | Card Type | Minimum Salary | Benefits |

|---|---|---|---|

| Emirates NBD | Visa Signature | AED 15,000 | Travel insurance, lounge access |

| FAB | Infinite Card | AED 20,000 | Luxury rewards, concierge services |

| ADCB | Emirates Skywards Card | AED 12,000 | Airline miles, travel perks |

These premium cards cater to higher earners. They often come with exclusive perks and rewards.

Navigating The Credit Card Application Process

Applying for a credit card in the UAE can seem complex. Understanding the requirements simplifies the process. Knowing the minimum earning threshold is crucial. This threshold often dictates your eligibility. Let’s break down the essential steps.

Documentation And Proof Of Income

Gathering the right documents is key. Banks require specific proofs to assess your application.

- Passport Copy: A clear copy of your passport.

- Residence Visa: Valid UAE residence visa copy.

- Emirates ID: A copy of your Emirates ID is mandatory.

- Proof of Income: Documents showcasing your income.

Common proof of income includes:

- Salary certificate from your employer.

- Latest bank statements for the last 3 months.

- Tax returns, if applicable.

Ensure all documents are up-to-date. Incomplete applications may lead to delays.

Dealing With Rejections And Alternatives

Facing rejection can be frustrating. Understanding the reasons helps in future applications. Common reasons for rejection include:

- Insufficient income.

- Poor credit score.

- Incomplete documentation.

If rejected, consider these alternatives:

| Alternative Option | Description |

|---|---|

| Secured Credit Card | Requires a deposit as collateral. |

| Joint Credit Card | Apply with a co-signer with good credit. |

| Prepaid Card | Load funds in advance; no credit check. |

Reassess your financial situation. Apply again with improved documentation.

Strategies To Meet Minimum Earnings Threshold

Meeting the minimum earning threshold for credit cards in the UAE is essential. Financial institutions require a specific income level to approve credit applications. Here are some effective strategies to help you achieve this goal.

Improving Your Credit Score

A strong credit score can enhance your chances of getting a credit card. Here are some tips to improve your credit score:

- Pay bills on time: Late payments can harm your score.

- Reduce debt: Keep your credit utilization below 30%.

- Check your credit report: Identify and correct errors.

- Limit new credit inquiries: Too many requests can lower your score.

Improving your credit score takes time. Start with these simple steps.

Exploring Additional Income Avenues

Finding new ways to increase your income can help you meet the threshold. Consider these options:

- Freelancing: Use your skills to earn extra cash.

- Part-time jobs: Look for flexible work opportunities.

- Online tutoring: Share your knowledge with students.

- Investing: Explore investment options for passive income.

Each of these avenues can boost your earnings significantly. Choose the ones that suit you best.

Expert Tips For First-time Applicants

Applying for a credit card in the UAE can be overwhelming. Understanding the requirements is key. This section shares expert tips for first-time applicants. Use these insights to make informed decisions.

Choosing The Right Card

Selecting a credit card is crucial. It can affect your financial health. Here are steps to help you choose wisely:

- Assess Your Needs: Determine what you will use the card for.

- Compare Rewards: Look for cards that offer rewards relevant to you.

- Check Fees: Be aware of annual fees and interest rates.

- Consider Benefits: Look for perks like travel insurance or cashback.

Use online comparison tools to simplify your search. Aim for a card that matches your spending habits.

Understanding The Fine Print

Reading the terms and conditions is essential. The fine print holds important information. Pay attention to these elements:

- Minimum Salary Requirement: Know the income threshold needed for approval.

- Interest Rates: Understand how interest is calculated on your balance.

- Fees: Be aware of late payment fees and foreign transaction fees.

- Grace Period: Learn about the time you have to pay before interest accrues.

Consider creating a checklist of these points. This helps you stay organized and informed.

Following these tips will make the application process smoother. Equip yourself with knowledge to choose wisely.

Future Outlook On Credit Card Eligibility

Understanding the future of credit card eligibility in the UAE is crucial. As the financial landscape evolves, so do the requirements for obtaining credit cards. This section explores predicted trends and potential regulatory changes affecting eligibility.

Predicted Trends In The Banking Sector

The banking sector in the UAE is changing rapidly. Here are some key trends to watch:

- Increased Digitalization: Banks will focus on online applications and approvals.

- Dynamic Earning Thresholds: Minimum salary requirements may become more flexible.

- Focus on Credit Scores: Banks will rely more on credit scores for eligibility.

- Personalized Offers: Tailored credit card options based on individual financial profiles.

These trends may make it easier for individuals to qualify for credit cards, even with lower salaries.

Potential Regulatory Changes

Regulatory bodies in the UAE may introduce new guidelines. Anticipated changes include:

- Revised Minimum Salary Requirements: The Central Bank may adjust thresholds based on economic conditions.

- Enhanced Consumer Protection: New regulations may protect consumers from unfair practices.

- Transparency in Fees: Clearer information on fees and charges will likely be mandated.

Such changes aim to create a more favorable environment for consumers seeking credit cards.

| Trend/Change | Description |

|---|---|

| Increased Digitalization | Shift towards online applications for convenience. |

| Dynamic Earning Thresholds | Flexible salary requirements for diverse applicants. |

| Revised Minimum Salary Requirements | Adjustments based on economic conditions for accessibility. |

| Enhanced Consumer Protection | New regulations ensuring fairness in lending. |

Staying informed about these trends and changes is essential for those interested in credit cards in the UAE.

Credit: www.khaleejuae.com

Frequently Asked Questions

How Much Salary Is Required For A Credit Card In The Uae?

To obtain a credit card in the UAE, a minimum salary of AED 5,000 is typically required. Some banks may offer cards with lower salary thresholds. Always check specific bank requirements for accurate eligibility criteria.

What Is The Minimum Score To Get Credit Card In Uae?

The minimum credit score to obtain a credit card in the UAE typically ranges from 620 to 650. Banks may also consider income and existing financial obligations. Always check with individual banks for specific requirements.

What Is The Minimum Salary For Arab Bank Credit Card?

The minimum salary required for an Arab Bank credit card is typically AED 5,000 per month. Meeting this threshold enhances your chances of approval. Always check with the bank for any specific requirements or changes.

What Is The Minimum Salary For Emirates Nbd Credit Card?

The minimum salary required for an Emirates NBD credit card is AED 5,000. Meeting this threshold helps ensure eligibility for various card options. Always check the latest requirements directly from Emirates NBD for any updates.

What Is The Minimum Salary For Credit Cards In Uae?

The minimum salary requirement typically starts at AED 5,000 for most banks offering credit cards in the UAE.

Conclusion

Navigating the credit card landscape in the UAE requires understanding the minimum earning thresholds. This knowledge empowers you to make informed financial decisions. Whether you’re applying for your first card or considering an upgrade, being aware of these thresholds can save you time and effort.

Always compare options to find the best fit for your needs.

Ahmed bin Rashid, a seasoned travel enthusiast and visa process expert and the successful Businessman in Dubai. With an LLB from the University of Bolton in 2015, he combines his legal knowledge with his passion for exploration, offering invaluable insights into Business formation and visa processes around the globe. Follow Ahmed’s captivating journeys and expert advice to embark on your unforgettable adventures & Business.