Many people in the UAE are avid credit card users, taking advantage of the various benefits and rewards that come with their cards. One of the most popular perks is the accumulation of credit card points. However, the question remains: are credit card points really worth it in the UAE?

Let’s dive into the world of credit card points and explore whether they are truly valuable to consumers in the UAE.

Understanding Credit Card Points

Credit card points are a form of reward offered by credit card companies to their customers. These points are typically earned by making purchases using the credit card, and the number of points accrued is often tied to the amount spent. Once enough points have been collected, cardholders can redeem them for a variety of rewards, including travel benefits, cashback, merchandise, and more.

The Pros of Credit Card Points

There are several advantages to using credit card points, particularly in the UAE. One of the primary benefits is the ability to earn rewards on everyday spending. By using a credit card for regular expenses such as groceries, bills, and entertainment, consumers can accumulate points without changing their spending habits.

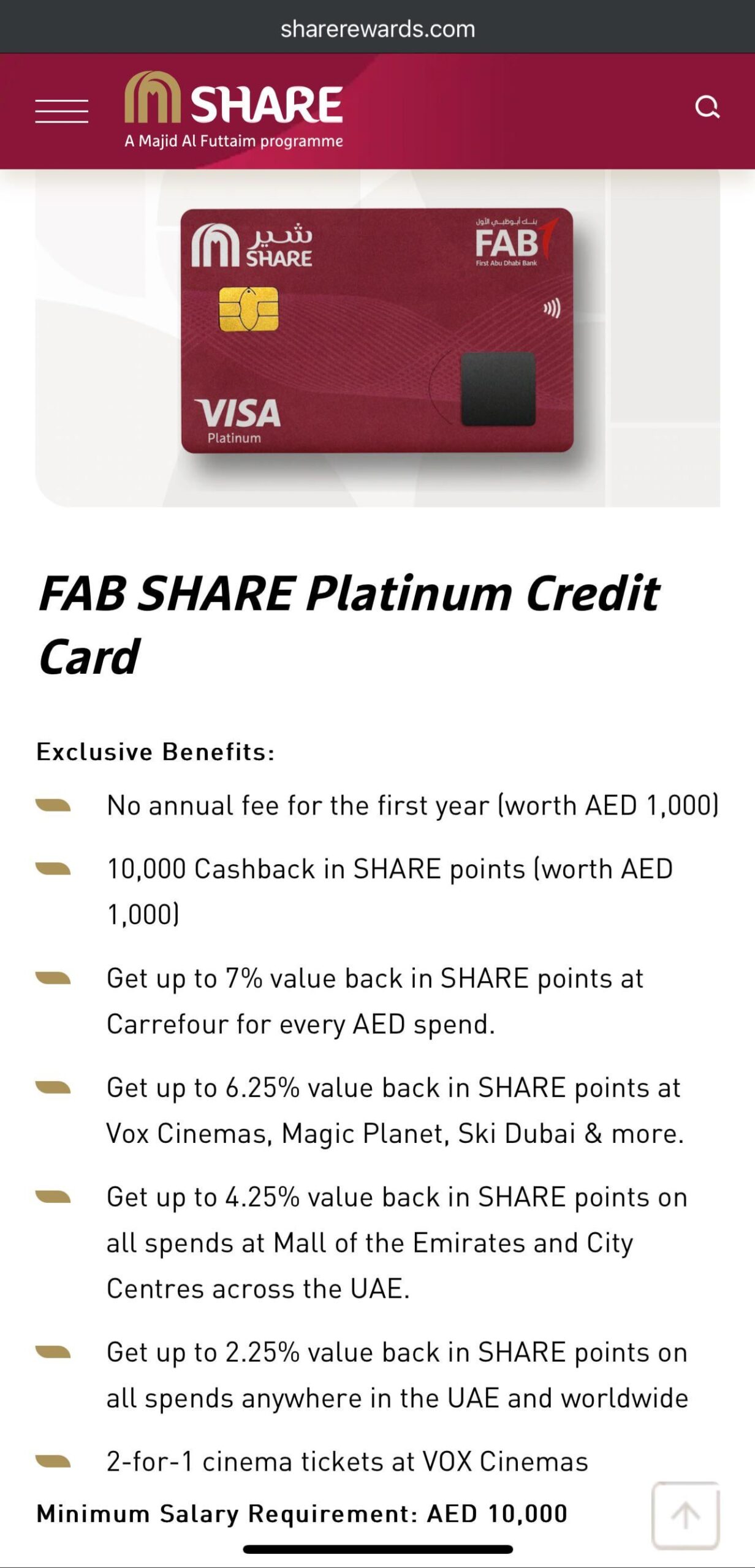

Additionally, many credit cards in the UAE offer sign-up bonuses and promotional offers that allow cardholders to earn a substantial number of points in a short period. These bonuses can be especially lucrative for those who are strategic about timing their credit card applications.

Furthermore, credit card points can provide significant value when redeemed for travel-related rewards. Many cards offer perks such as free flights, hotel stays, airport lounge access, and travel insurance, making them particularly appealing to frequent travelers or those looking to maximize the value of their points.

The Cons of Credit Card Points

While credit card points offer numerous advantages, there are also potential downsides to consider. One of the main drawbacks is the complexity of reward programs. Some credit card companies have intricate redemption processes, blackout dates for travel rewards, and limited availability for certain merchandise, making it challenging for consumers to fully utilize their points.

Additionally, the value of credit card points can fluctuate over time, and some rewards may depreciate in worth. This means that points accumulated today might not have the same purchasing power in the future, especially as inflation and changes in the market affect the value of rewards.

Another important factor to consider is the annual fees and interest rates associated with credit cards. While some cards offer generous point accrual, they may come with high annual fees and interest charges, which can offset the value of the rewards earned.

Maximizing the Value of Credit Card Points in the UAE

For consumers in the UAE, there are several strategies to maximize the value of credit card points and ensure that they are worth the investment. One approach is to carefully compare different credit card offers and select a card that aligns with one’s spending habits and financial goals. By choosing a card with favorable earning rates, sign-up bonuses, and redemption options, individuals can optimize their point accumulation and utilization.

Another effective strategy is to stay informed about special promotions and limited-time offers from credit card companies. Many issuers in the UAE run promotions that allow cardholders to earn bonus points or receive enhanced rewards for specific categories of spending, such as dining, shopping, or travel. By taking advantage of these promotions, consumers can amplify their point earnings and extract more value from their cards.

Furthermore, it’s essential for credit card users to stay organized and track their points diligently. By monitoring point balances, expiration dates, and redemption opportunities, individuals can avoid losing out on valuable rewards and make the most of their credit card benefits.

Conclusion

So, are credit card points worth it in the UAE? The answer ultimately depends on individual spending habits, financial objectives, and the specific terms and conditions of the credit card in question. While credit card points can offer substantial rewards and perks, it’s crucial for consumers to weigh the pros and cons carefully and adopt a strategic approach to maximize the value of their points.

By understanding the intricacies of credit card points, staying informed about promotions, and selecting the right card for their needs, consumers in the UAE can leverage credit card points to their advantage and enjoy the various benefits they have to offer.

Ahmed bin Rashid, a seasoned travel enthusiast and visa process expert and the successful Businessman in Dubai. With an LLB from the University of Bolton in 2015, he combines his legal knowledge with his passion for exploration, offering invaluable insights into Business formation and visa processes around the globe. Follow Ahmed’s captivating journeys and expert advice to embark on your unforgettable adventures & Business.