How Credit Card Balance Transfer Works in UAE

If you have been struggling to manage multiple credit card payments, a balance transfer could be the solution you need. In the UAE, credit card balance transfers are a popular tool for consolidating debt and saving money on interest payments. In this article, we will explore how credit card balance transfers work in the UAE and the benefits they offer to consumers.

What is a Credit Card Balance Transfer?

A credit card balance transfer involves moving the outstanding balance from one credit card to another, typically to take advantage of a lower interest rate or better terms. This process allows you to consolidate your debts onto a single card, making it easier to manage your payments and potentially save money on interest charges.

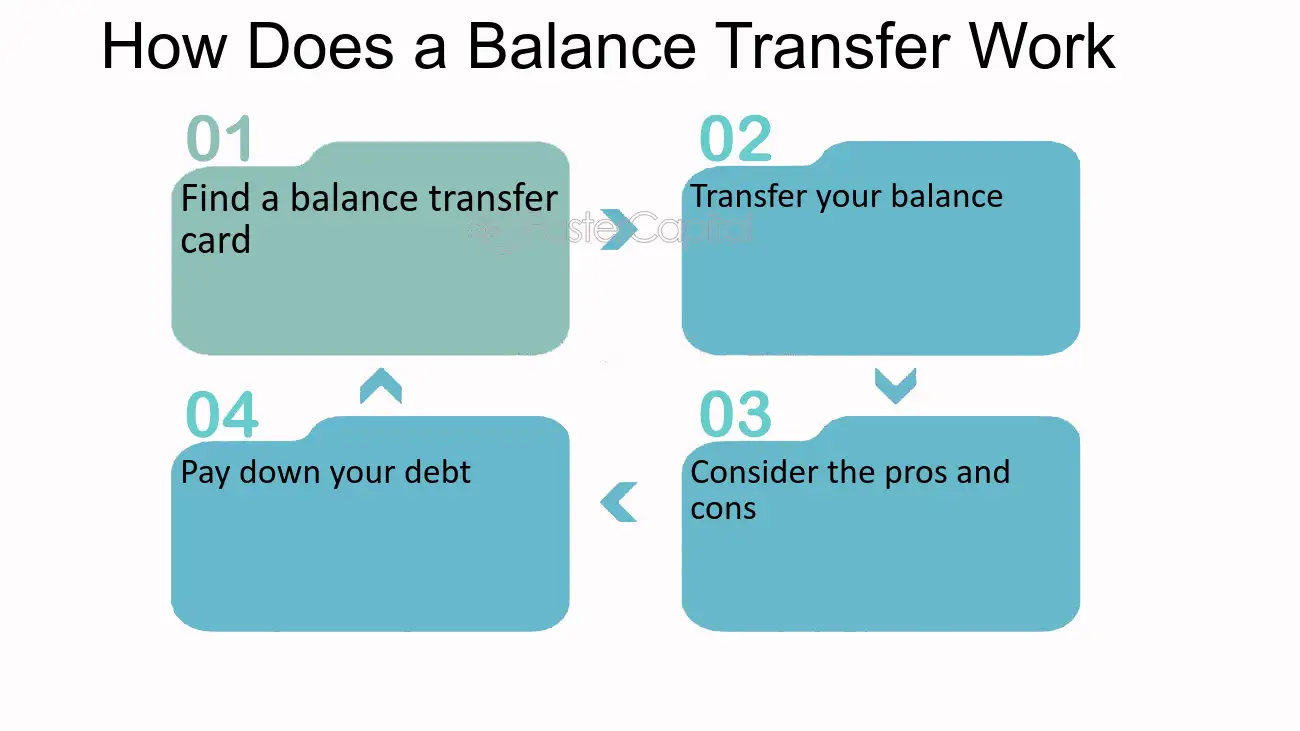

How Does a Credit Card Balance Transfer Work?

When you apply for a balance transfer, the new credit card issuer will pay off the outstanding balance on your existing credit card(s) and transfer the debt to your new card. This effectively shifts your debt from one lender to another, often with the incentive of a lower interest rate or an introductory period with 0% interest.

Benefits of Credit Card Balance Transfers in the UAE

There are several benefits to taking advantage of a credit card balance transfer in the UAE:

1. Consolidate Debt: By combining multiple credit card balances onto a single card, you can simplify your finances and make it easier to manage your payments.

2. Save Money on Interest: If you transfer your balance to a card with a lower interest rate or a promotional 0% APR period, you can save money on interest charges and pay off your debt more quickly.

3. Improve Cash Flow: Lowering your monthly interest payments can free up more of your income for other expenses or savings, improving your overall financial flexibility.

4. Streamline Payments: With a single monthly payment, you can avoid the hassle of managing multiple credit card due dates and minimum payments, reducing the risk of missed payments and late fees.

5. Build Credit Score: By effectively managing your debt through a balance transfer, you can demonstrate responsible financial behavior and potentially improve your credit score over time.

How to Apply for a Credit Card Balance Transfer in the UAE

If you are considering a balance transfer, here are the general steps to follow:

1. Research and Compare Offers: Start by researching the various credit card balance transfer offers available in the UAE. Look for cards with competitive interest rates, favorable terms, and any promotional periods for 0% APR.

2. Check Eligibility: Review the eligibility criteria for each card to ensure you meet the requirements for a balance transfer. This may include a minimum credit score, income level, and existing debt obligations.

3. Apply for the Card: Once you have identified a suitable balance transfer offer, complete the credit card application process, providing the necessary documentation and personal information.

4. Request the Balance Transfer: After receiving approval for the new credit card, contact the issuer to initiate the balance transfer process. You will need to provide the details of your existing credit card accounts and the amount you wish to transfer.

5. Review the Terms: Carefully review the terms and conditions of the balance transfer, including any fees, the duration of promotional rates, and the ongoing interest rate after the promotional period ends.

6. Complete the Transfer: Once the balance transfer is approved, the new credit card issuer will pay off your existing balances and move the debt to your new card. Keep track of the transfer to ensure it is processed correctly and in a timely manner.

7. Manage Payments: With the balance transferred to your new card, continue to make regular payments to pay down the debt, taking advantage of any promotional periods to minimize interest charges.

Considerations for Credit Card Balance Transfers in the UAE

While credit card balance transfers can offer significant advantages, it is essential to consider the following factors before proceeding:

1. Balance Transfer Fees: Some credit card issuers may charge a fee for transferring a balance, typically calculated as a percentage of the amount being transferred. Be sure to factor in these costs when evaluating the potential savings of a balance transfer.

2. Introductory Periods: If you are taking advantage of a promotional 0% APR period, understand the duration of this offer and the interest rate that will apply once the promotional period ends.

3. Credit Score Impact: Applying for a new credit card and transferring balances can impact your credit score, so be mindful of how these actions may affect your overall creditworthiness.

4. Minimum Payments: Even with a lower interest rate or promotional period, it is crucial to make at least the minimum monthly payments on your new credit card to avoid penalties and maintain the benefits of the balance transfer.

Conclusion

In conclusion, credit card balance transfers can be a valuable tool for managing debt and saving money on interest payments in the UAE. By consolidating your credit card balances onto a single card with favorable terms, you can streamline your payments, improve your cash flow, and work towards becoming debt-free more efficiently. However, it is essential to research and compare offers carefully, consider the associated fees and terms, and manage your payments responsibly to make the most of a credit card balance transfer. With a strategic approach, a balance transfer can be a smart financial move to achieve greater control over your debt and financial well-being.

Ahmed bin Rashid, a seasoned travel enthusiast and visa process expert and the successful Businessman in Dubai. With an LLB from the University of Bolton in 2015, he combines his legal knowledge with his passion for exploration, offering invaluable insights into Business formation and visa processes around the globe. Follow Ahmed’s captivating journeys and expert advice to embark on your unforgettable adventures & Business.