Title: How Credit Card Frauds are Caught in UAE

Introduction

Credit card fraud is a widespread issue that affects individuals and businesses across the globe. In the United Arab Emirates (UAE), authorities have implemented various measures to detect and prevent credit card fraud. This article will explore how credit card frauds are caught in the UAE and the technologies and strategies used to combat this criminal activity.

Understanding Credit Card Fraud

Credit card fraud involves the unauthorized use of a credit or debit card to make purchases or withdrawals. Fraudulent activities can range from stolen card information used for online transactions to elaborate schemes involving counterfeit cards and identity theft. In the UAE, credit card fraud is considered a serious offense, and law enforcement agencies work diligently to identify and apprehend perpetrators.

Detecting Credit Card Fraud in the UAE

The UAE employs advanced technologies and collaborative efforts among financial institutions, law enforcement agencies, and regulatory bodies to detect and prevent credit card fraud. Some of the key methods used to catch credit card fraud in the UAE include:

1. Transaction Monitoring Systems: Financial institutions in the UAE utilize sophisticated transaction monitoring systems to identify unusual or suspicious activities associated with credit card transactions. These systems analyze patterns, anomalies, and discrepancies to flag potentially fraudulent transactions for further investigation.

2. Machine Learning and AI: Artificial intelligence (AI) and machine learning algorithms are employed to detect patterns and trends indicative of fraudulent activities. These technologies can analyze large volumes of transaction data in real-time to identify potential fraud and take immediate action to prevent further losses.

3. EMV Chip Technology: The UAE has adopted EMV chip technology for credit and debit cards, which provides enhanced security features to combat counterfeit card fraud. The embedded microchip generates unique transaction codes for each transaction, making it challenging for fraudsters to replicate card information for unauthorized use.

4. Biometric Authentication: Some credit card issuers in the UAE have implemented biometric authentication methods, such as fingerprint or facial recognition, to verify cardholders’ identities during transactions. This additional layer of security reduces the risk of unauthorized card usage.

5. Collaboration and Information Sharing: Financial institutions, law enforcement agencies, and regulatory bodies in the UAE collaborate to share information and intelligence related to credit card fraud. This collaborative approach enables swift action against fraudsters and facilitates the exchange of best practices for fraud prevention.

Preventing Credit Card Fraud Through Education and Awareness

In addition to technological advancements, raising awareness and educating the public about credit card fraud prevention is a crucial aspect of combating this criminal activity. The UAE government and financial institutions conduct awareness campaigns to educate consumers about safe practices for using credit cards and protecting their personal and financial information. These initiatives aim to empower individuals to recognize potential fraud indicators and take proactive measures to safeguard their financial assets.

Reporting and Investigating Credit Card Fraud Cases

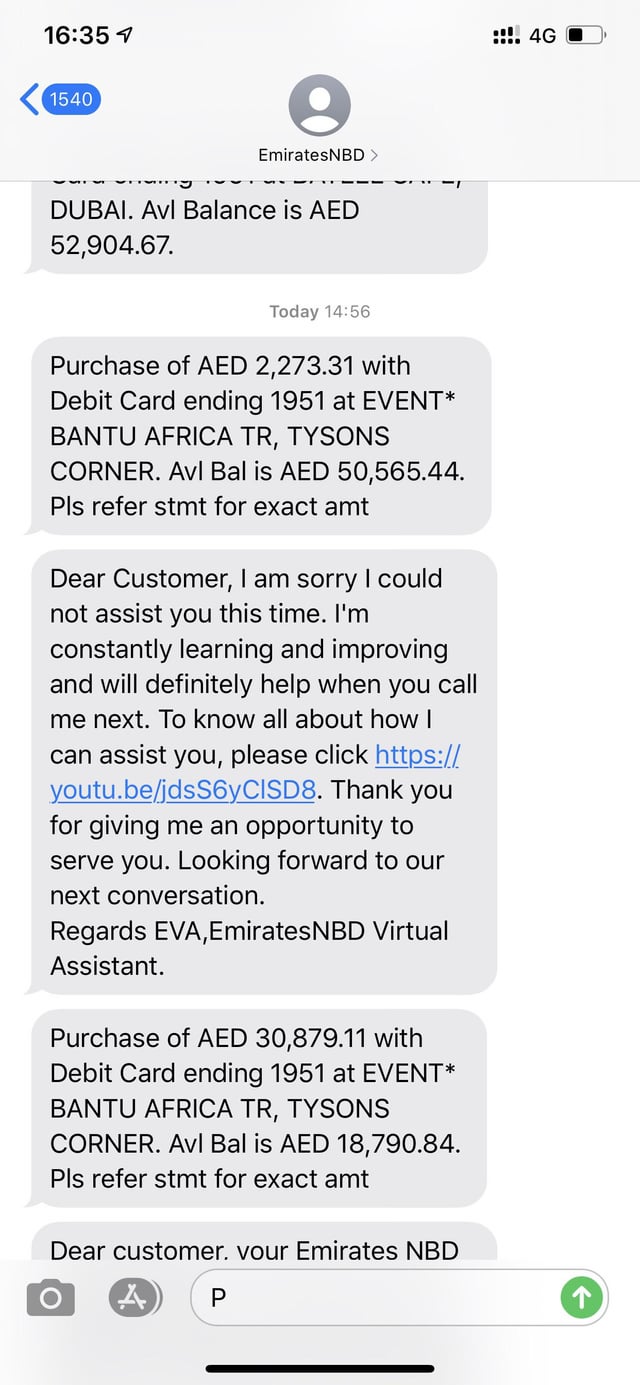

Individuals who suspect or experience credit card fraud in the UAE are encouraged to report the incidents to their respective financial institutions and law enforcement authorities promptly. Upon receiving reports of potential fraud, authorities initiate thorough investigations to identify the perpetrators and gather evidence for prosecution. Timely reporting of fraud cases is essential for law enforcement agencies to take swift action and prevent further financial losses.

Legal Consequences for Credit Card Fraud in the UAE

Credit card fraud is a criminal offense in the UAE, and individuals found guilty of engaging in fraudulent activities face severe legal consequences. The UAE has stringent laws and regulations in place to prosecute and punish offenders involved in credit card fraud. Perpetrators may be subject to imprisonment, fines, and other penalties as prescribed by the law.

Conclusion

Credit card fraud detection and prevention efforts in the UAE are multifaceted, incorporating advanced technologies, collaboration among stakeholders, public awareness initiatives, and stringent legal measures. By leveraging these strategies, the UAE aims to safeguard the integrity of its financial systems and protect consumers from falling victim to fraudulent activities. Continued vigilance, innovation, and cooperation among all relevant parties are essential in the ongoing fight against credit card fraud in the UAE.

Ahmed bin Rashid, a seasoned travel enthusiast and visa process expert and the successful Businessman in Dubai. With an LLB from the University of Bolton in 2015, he combines his legal knowledge with his passion for exploration, offering invaluable insights into Business formation and visa processes around the globe. Follow Ahmed’s captivating journeys and expert advice to embark on your unforgettable adventures & Business.