Are you considering applying for a loan in the UAE? First Abu Dhabi Bank, commonly known as FAB Bank, offers a wide range of loan products to cater to the diverse financial needs of individuals. Whether you are looking to finance your dream home, purchase a new car, or fund your child’s education, FAB Bank has you covered. In this guide, we will walk you through the process of applying for a loan in FAB Bank, helping you navigate the steps with ease.

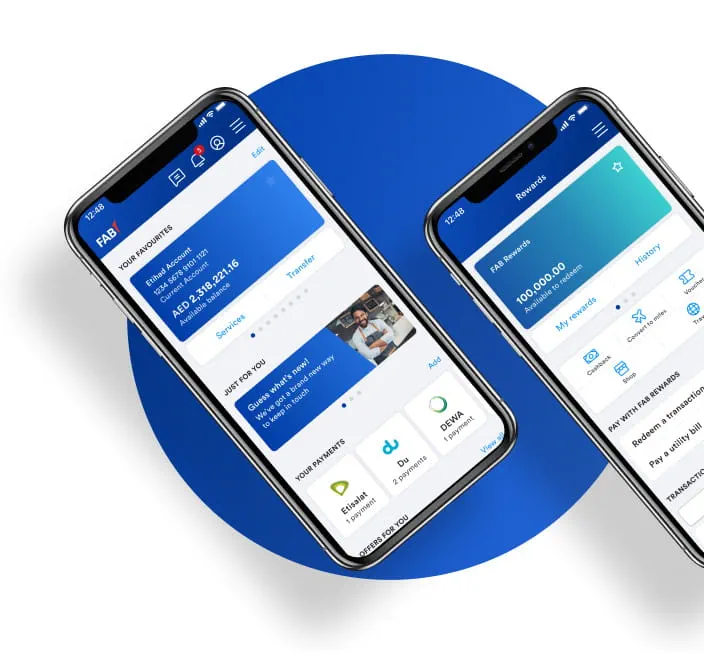

Credit: www.bankfab.com

Types of Loans Offered by FAB Bank

Before you start the loan application process, it’s essential to understand the different types of loans offered by FAB Bank. Here are some of the most common loan products available:

- Personal Loans

- Auto Loans

- Home Loans

- Business Loans

- Education Loans

Each type of loan has its own set of eligibility criteria, interest rates, and repayment terms. Depending on your financial needs, you can choose the loan product that best suits your requirements.

Eligibility Criteria for Applying for a Loan in FAB Bank

Before you submit your loan application, you need to ensure that you meet the eligibility criteria set by FAB Bank. Here are some common eligibility requirements:

- Minimum age of 21 years

- UAE residency visa

- Minimum income requirement

- Good credit history

It’s essential to review the specific eligibility criteria for the type of loan you are applying for to increase your chances of approval.

Credit: thebanksinsider.com

Documents Required for Loan Application

When applying for a loan in FAB Bank, you will need to provide certain documents to support your application. Here are some of the common documents required:

| Document | Personal Loan | Auto Loan | Home Loan |

|---|---|---|---|

| Valid Emirates ID | ✔ | ✔ | ✔ |

| Passport copy | ✔ | ✔ | ✔ |

| Proof of income | ✔ | ✔ | ✔ |

| Bank statements | ✔ | ✔ | ✔ |

Make sure you have all the necessary documents ready before you start the loan application process to avoid any delays.

Steps to Apply for a Loan in FAB Bank

Now that you have gathered all the required documents and meet the eligibility criteria, it’s time to start the loan application process. Here are the steps to apply for a loan in FAB Bank:

- Visit the FAB Bank website or branch

- Fill out the loan application form

- Submit the required documents

- Wait for loan approval

- Review and sign the loan agreement

- Receive the loan amount in your account

By following these steps diligently, you can ensure a smooth loan application process with FAB Bank.

Tips for a Successful Loan Application

Here are some tips to increase your chances of a successful loan application in FAB Bank:

- Maintain a good credit score

- Provide accurate and up-to-date information

- Choose the right loan product for your needs

- Review the terms and conditions carefully

- Seek advice from a financial advisor if needed

By following these tips, you can enhance your application and secure the loan you need from FAB Bank.

Benefits of Applying for a Loan in FAB Bank

There are several benefits to choosing FAB Bank for your loan needs:

- Competitive interest rates

- Flexible repayment terms

- Quick approval process

- Excellent customer service

- Wide range of loan products

With FAB Bank, you can enjoy a seamless borrowing experience and access the funds you need to fulfill your financial goals.

Frequently Asked Questions

How Can I Apply For A Loan In Fab Bank?

To apply for a loan in Fab Bank, you can either visit a branch or apply online through their website. Make sure you have all the required documents ready for a smooth process.

What Type Of Loans Does Fab Bank Offer?

Fab Bank offers a variety of loans such as personal loans, auto loans, home loans, business loans, and more. You can choose the loan that best suits your needs and requirements.

What Are The Eligibility Criteria For A Loan In Fab Bank?

The eligibility criteria for a loan in Fab Bank vary depending on the type of loan. Generally, you need to have a stable income, a good credit score, and meet the minimum age requirement.

How Long Does It Take For A Loan To Get Approved In Fab Bank?

The loan approval process in Fab Bank usually takes a few days. However, it may vary depending on the type of loan, the documentation provided, and the applicant’s eligibility.

Can I Track My Loan Application Status In Fab Bank?

Yes, you can track your loan application status in Fab Bank by logging in to your account on their website or contacting their customer service center. They will provide you with regular updates on your application.

Conclusion

Applying for a loan in FAB Bank is a straightforward process if you meet the eligibility criteria and have all the necessary documents ready. By following the steps outlined in this guide and adhering to the tips provided, you can increase your chances of a successful loan application. Remember to choose the loan product that best suits your financial needs and review the terms and conditions carefully before signing the agreement. With FAB Bank, you can access a wide range of loan products with competitive interest rates and flexible repayment terms to help you achieve your financial aspirations.

So, if you are in need of financial assistance, consider applying for a loan in FAB Bank today and take a step closer to realizing your dreams.

Ahmed bin Rashid, a seasoned travel enthusiast and visa process expert and the successful Businessman in Dubai. With an LLB from the University of Bolton in 2015, he combines his legal knowledge with his passion for exploration, offering invaluable insights into Business formation and visa processes around the globe. Follow Ahmed’s captivating journeys and expert advice to embark on your unforgettable adventures & Business.