Calculating corporate tax in the UAE can seem complex. But with this guide, it will be simple. We will break it down into easy steps. Follow along to understand everything.

What is Corporate Tax?

Corporate tax is a tax on a company’s profit. Companies must pay this to the government. This money helps the country run smoothly.

Why is Corporate Tax Important?

Corporate tax is important for many reasons. It helps fund public services. These include schools, hospitals, and roads. It also ensures businesses contribute to the community.

Credit: profitbooks.net

Corporate Tax Rates in UAE

In the UAE, corporate tax rates are simple. Let’s look at the rates.

| Profit Range | Tax Rate |

|---|---|

| Up to AED 375,000 | 0% |

| Above AED 375,000 | 9% |

Companies with profits up to AED 375,000 pay no tax. Companies with higher profits pay a 9% tax.

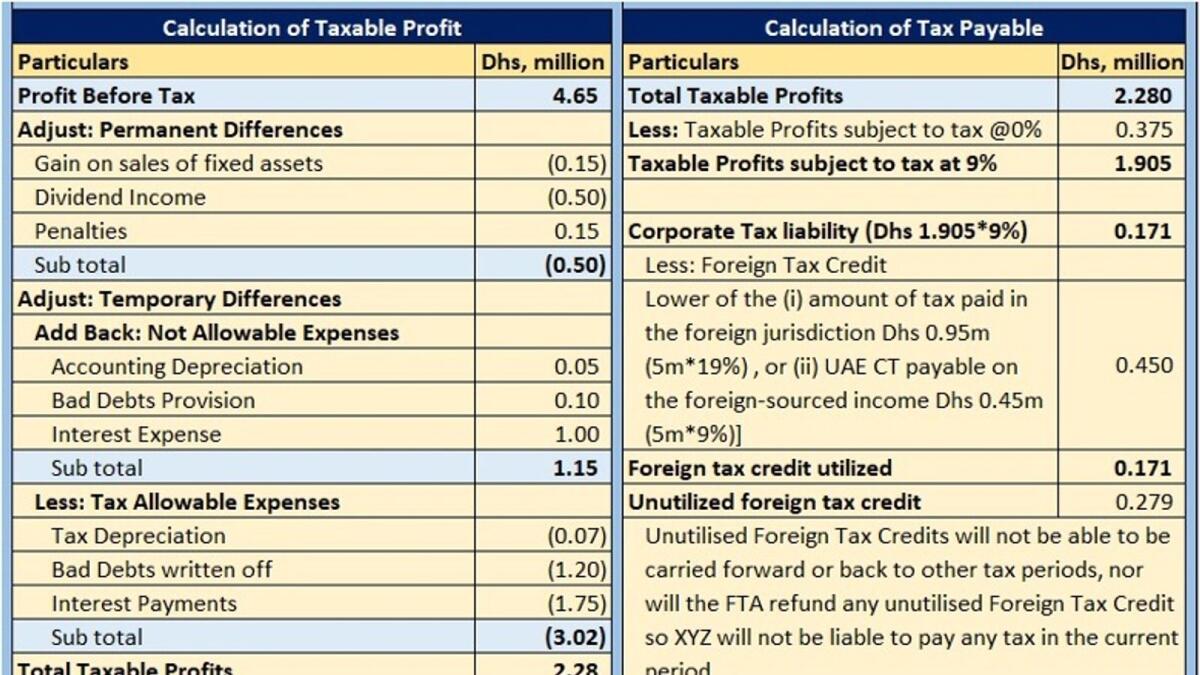

Credit: www.khaleejtimes.com

Steps to Calculate Corporate Tax

Follow these steps to calculate corporate tax in the UAE.

- Calculate your total revenue.

- Subtract any allowable expenses.

- Determine your taxable profit.

- Apply the tax rate to your taxable profit.

Step 1: Calculate Your Total Revenue

Total revenue is all the money your company makes. Add up all your sales and income. This is your total revenue.

Step 2: Subtract Any Allowable Expenses

Allowable expenses are costs you can subtract from your revenue. These include rent, salaries, and supplies. Subtract these from your total revenue.

Step 3: Determine Your Taxable Profit

Taxable profit is what is left after subtracting expenses. This is the amount you will be taxed on.

Step 4: Apply The Tax Rate

Use the tax rates from the table above. Apply the correct rate to your taxable profit.

Example Calculation

Let’s look at an example.

Imagine your company has a total revenue of AED 500,000. Your allowable expenses are AED 100,000. Here is how you calculate your tax.

| Item | Amount (AED) |

|---|---|

| Total Revenue | 500,000 |

| Allowable Expenses | (100,000) |

| Taxable Profit | 400,000 |

| Tax Rate | 9% |

| Tax Due | 36,000 |

Your taxable profit is AED 400,000. Since this is above AED 375,000, you pay 9%. So, your tax due is AED 36,000.

Important Tips for Calculating Corporate Tax

Here are some tips to help you.

- Keep accurate records of all income and expenses.

- Understand which expenses are allowable.

- Stay updated on any changes in tax laws.

- Consider hiring a tax professional if needed.

Frequently Asked Questions

What Is Corporate Tax In Uae?

Corporate tax in UAE is a tax imposed on net profits of businesses.

Who Pays Corporate Tax In Uae?

UAE-based businesses with taxable income exceeding AED 375,000 must pay corporate tax.

How Is Corporate Tax Calculated?

Corporate tax is calculated on the net profits of a business after allowable deductions.

What Is The Corporate Tax Rate In Uae?

The corporate tax rate in UAE is 9%.

Conclusion

Calculating corporate tax in the UAE is straightforward. Understand the tax rates and follow the steps. Keep good records and stay informed. This ensures you pay the correct amount.

Ahmed bin Rashid, a seasoned travel enthusiast and visa process expert and the successful Businessman in Dubai. With an LLB from the University of Bolton in 2015, he combines his legal knowledge with his passion for exploration, offering invaluable insights into Business formation and visa processes around the globe. Follow Ahmed’s captivating journeys and expert advice to embark on your unforgettable adventures & Business.