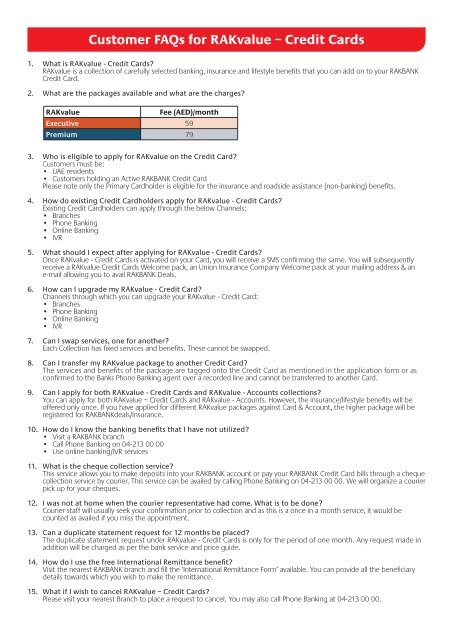

RAK Bank, also known as the National Bank of Ras Al Khaimah, is one of the leading banks in the UAE, providing a wide range of banking services to its customers. One of the essential features offered by RAK Bank is the ability to create beneficiaries, which allows customers to transfer funds conveniently and securely. In this article, we will guide you through the process of creating a beneficiary in RAK Bank, enabling you to make seamless transactions.

Why Create a Beneficiary?

Before we delve into the process of creating a beneficiary in RAK Bank, let’s understand the significance of this feature. Creating a beneficiary allows you to transfer funds to the designated recipient without the need to input their details every time you make a transaction. This streamlines the process and minimizes the chances of errors, making fund transfers more efficient and secure.

Steps to Create a Beneficiary in RAK Bank

Creating a beneficiary in RAK Bank is a simple and straightforward process. Here are the steps you need to follow:

Step 1: Log In To Your Rak Bank Online Banking Account

Start by logging in to your RAK Bank online banking account using your username and password. Once you have successfully logged in, navigate to the fund transfer section.

Step 2: Select “manage Beneficiaries”

Within the fund transfer section, look for the option to manage beneficiaries. Click on this option to proceed to the next step.

Step 3: Add A New Beneficiary

Once you are in the manage beneficiaries section, you will have the option to add a new beneficiary. Click on the “Add New Beneficiary” or similar button to initiate the beneficiary creation process.

Step 4: Enter Beneficiary Details

Next, you will be prompted to enter the details of the beneficiary, including their full name, bank account number, bank name, and any other relevant information. It is crucial to ensure that the details entered are accurate to avoid any potential issues with the fund transfer.

Step 5: Verify And Confirm

After entering the beneficiary details, take a moment to review the information to ensure its accuracy. Once you are satisfied that all the details are correct, proceed to confirm the addition of the new beneficiary.

Step 6: Activation And Verification

Upon confirming the addition of the new beneficiary, RAK Bank may require you to verify the beneficiary through a one-time password (OTP) sent to your registered mobile number or email address. This additional layer of security helps safeguard your transactions.

Step 7: Confirmation Of Beneficiary Addition

Once the beneficiary has been successfully added and verified, you will receive a confirmation message or email from RAK Bank, indicating that the new beneficiary has been created and is ready for use.

Tips for Creating Beneficiaries in RAK Bank

While the process of creating a beneficiary in RAK Bank is relatively simple, there are a few tips to keep in mind to ensure a smooth experience:

- Double-Check Details: Always double-check the beneficiary details before confirming to avoid any errors in the fund transfer process.

- Use Secure Network: Ensure that you are using a secure and private network when adding beneficiaries to your RAK Bank account to protect your sensitive information.

- Keep Contact Information Updated: Make sure your registered mobile number and email address are up to date to receive any verification codes or confirmation messages promptly.

- Follow Security Best Practices: Adhere to security best practices recommended by RAK Bank to safeguard your online banking activities and transactions.

Credit: m.youtube.com

Benefits of Creating Beneficiaries

Now that you are familiar with the process of creating a beneficiary in RAK Bank, let’s explore the benefits of this feature:

- Convenience: Creating beneficiaries simplifies the fund transfer process, allowing you to make quick and hassle-free transactions.

- Efficiency: With pre-registered beneficiary details, you can save time and effort by avoiding the need to input recipient information for every transfer.

- Security: By adding and verifying beneficiaries, RAK Bank enhances the security of your transactions, reducing the risk of unauthorized fund transfers.

- Peace of Mind: Knowing that your beneficiaries are securely registered in your account gives you peace of mind when making transactions, ensuring a reliable transfer process.

Credit: www.emiratesnbd.com

In Conclusion

Creating beneficiaries in RAK Bank is a valuable feature that enhances the efficiency and security of your fund transfers. By following the simple steps outlined in this guide and keeping the tips in mind, you can seamlessly add and manage beneficiaries in your RAK Bank account, empowering you to conduct transactions with ease and confidence.

Remember to prioritize the accuracy of beneficiary details, maintain security best practices, and stay informed about the benefits of this feature to maximize your banking experience with RAK Bank.

With the convenience and security offered by beneficiary creation, RAK Bank continues to empower its customers with robust banking solutions, ensuring a seamless and reliable banking experience.

Ahmed bin Rashid, a seasoned travel enthusiast and visa process expert and the successful Businessman in Dubai. With an LLB from the University of Bolton in 2015, he combines his legal knowledge with his passion for exploration, offering invaluable insights into Business formation and visa processes around the globe. Follow Ahmed’s captivating journeys and expert advice to embark on your unforgettable adventures & Business.