VAT filing in the UAE can seem complicated. But with the right steps, you can do it easily. This guide will help you understand how to file VAT in the UAE.

What is VAT?

VAT stands for Value Added Tax. It is a tax on the value added to goods and services. In the UAE, VAT is 5%. Businesses must collect this tax from customers and pay it to the government.

Who Needs to File VAT?

Businesses that make more than AED 375,000 in a year must file VAT. Some smaller businesses may also choose to file VAT.

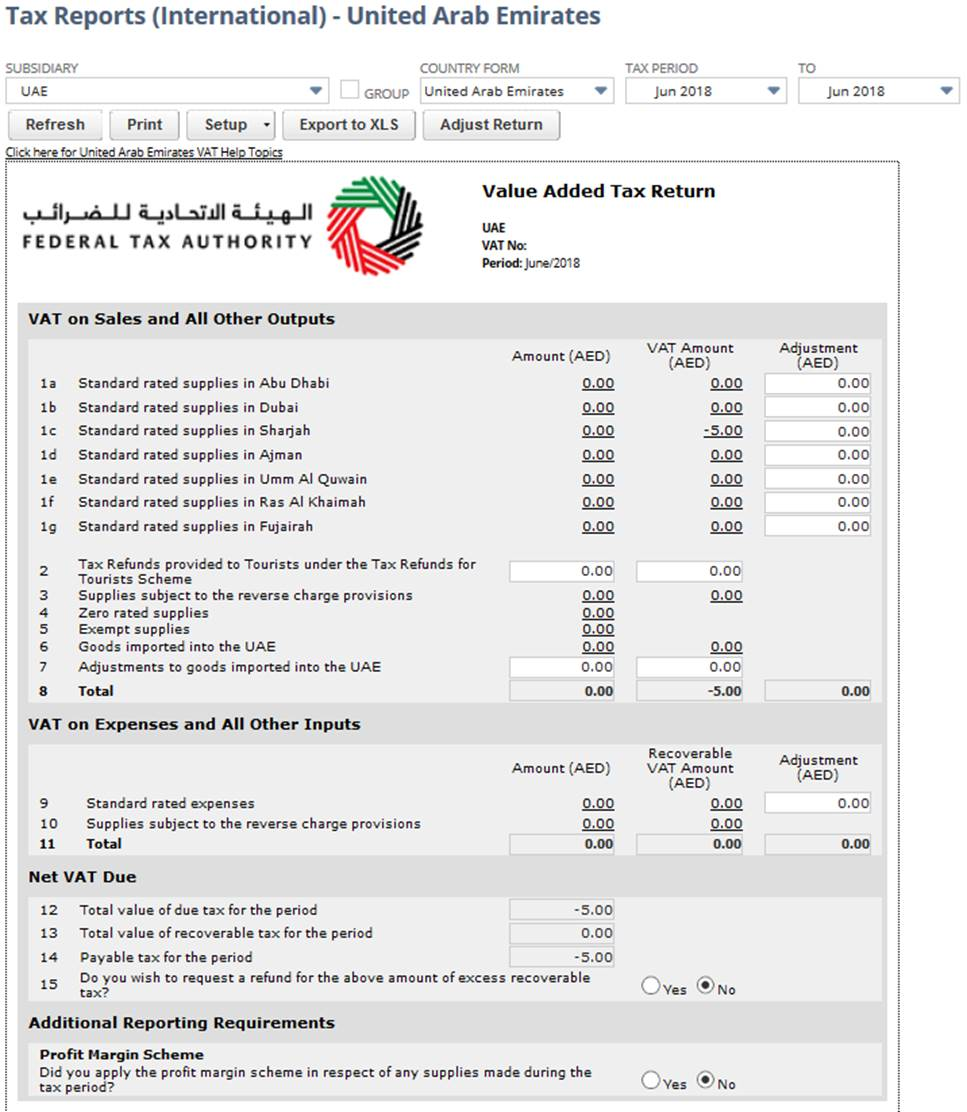

Credit: tallysolutions.com

Steps to File VAT in UAE

Follow these steps to file VAT in the UAE:

1. Register For Vat

- Go to the Federal Tax Authority (FTA) website.

- Fill out the VAT registration form.

- Submit the form with all required documents.

- Wait for your VAT registration number.

2. Keep Proper Records

- Keep all invoices and receipts.

- Record all sales and purchases.

- Use accounting software if possible.

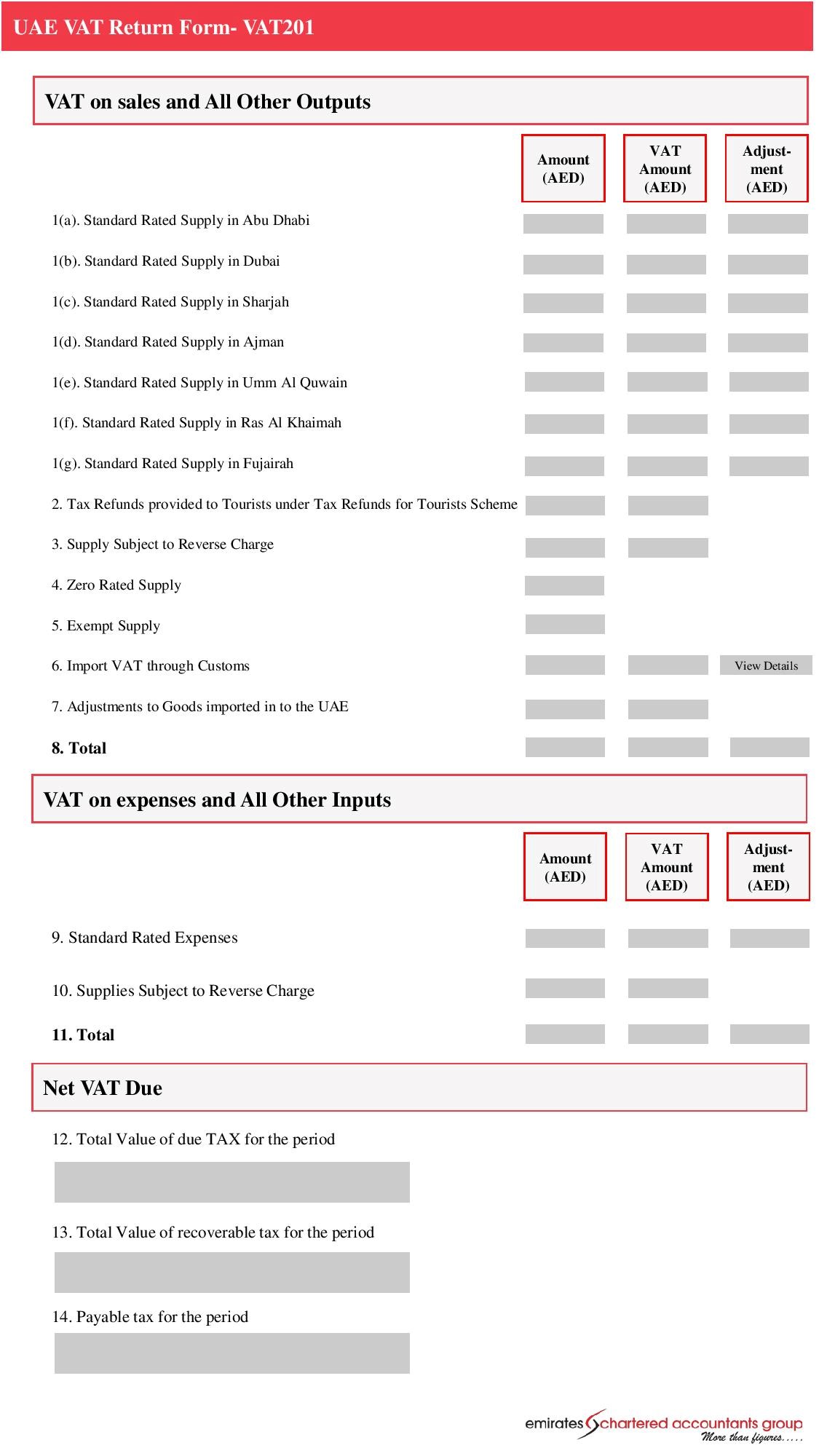

3. Prepare Your Vat Return

- Log in to the FTA portal.

- Go to the VAT returns section.

- Fill out the VAT return form.

- Include all sales and purchases.

- Check for errors before submitting.

4. Submit Your Vat Return

- Submit the VAT return form online.

- Do this by the deadline to avoid fines.

5. Pay Your Vat

- After submitting, you will see the amount you owe.

- Pay this amount to the FTA.

- You can pay online or through a bank transfer.

Important Dates

VAT returns must be filed every three months. Here are some important dates to remember:

| Quarter | Filing Deadline |

|---|---|

| January – March | April 28 |

| April – June | July 28 |

| July – September | October 28 |

| October – December | January 28 |

Credit: www.emiratesca.com

Common Mistakes to Avoid

Here are some common mistakes to avoid when filing VAT:

- Not registering on time.

- Not keeping proper records.

- Making errors on the VAT return form.

- Missing the filing deadline.

- Not paying the VAT amount due.

Frequently Asked Questions

What Is Vat Filing In Uae?

VAT filing in UAE involves submitting VAT returns to the Federal Tax Authority.

Who Needs To File Vat In Uae?

Businesses exceeding AED 375,000 in taxable supplies must file VAT.

How Often Is Vat Filed In Uae?

VAT is usually filed quarterly, sometimes monthly.

What Documents Are Required For Vat Filing?

You need sales, purchases, and expense records.

Conclusion

VAT filing in the UAE is important for businesses. Follow the steps in this guide to file your VAT correctly. This will help you avoid fines and keep your business running smoothly.

Frequently Asked Questions

What Happens If I Don’t File Vat On Time?

If you don’t file VAT on time, you may face fines. It is important to file on time to avoid penalties.

Can I File Vat Myself Or Do I Need An Accountant?

You can file VAT yourself if you understand the process. But many businesses hire accountants to help with VAT filing.

Is There Any Software To Help With Vat Filing?

Yes, there are many accounting software options. These can help you keep records and file VAT easily.

What If I Make A Mistake On My Vat Return?

If you make a mistake, you can correct it in the next return. Make sure to keep accurate records to avoid mistakes.

How Do I Know How Much Vat To Pay?

After you submit your VAT return, the FTA will tell you the amount. Make sure to pay this amount by the deadline.

Useful Links

Contact Information

If you need help with VAT filing, you can contact the FTA:

Thank you for reading this guide on how to do VAT filing in the UAE. We hope this helps you file your VAT correctly and on time.

Ahmed bin Rashid, a seasoned travel enthusiast and visa process expert and the successful Businessman in Dubai. With an LLB from the University of Bolton in 2015, he combines his legal knowledge with his passion for exploration, offering invaluable insights into Business formation and visa processes around the globe. Follow Ahmed’s captivating journeys and expert advice to embark on your unforgettable adventures & Business.