Welcome to our guide on VAT registration in the UAE. Value Added Tax (VAT) is a tax on goods and services. If you run a business in the UAE, you must understand VAT.

Credit: www.linkedin.com

What is VAT?

VAT stands for Value Added Tax. It is a type of tax added to goods and services. The UAE introduced VAT on January 1, 2018.

The standard VAT rate in the UAE is 5%. Some items are exempt or zero-rated.

Who Needs to Register for VAT?

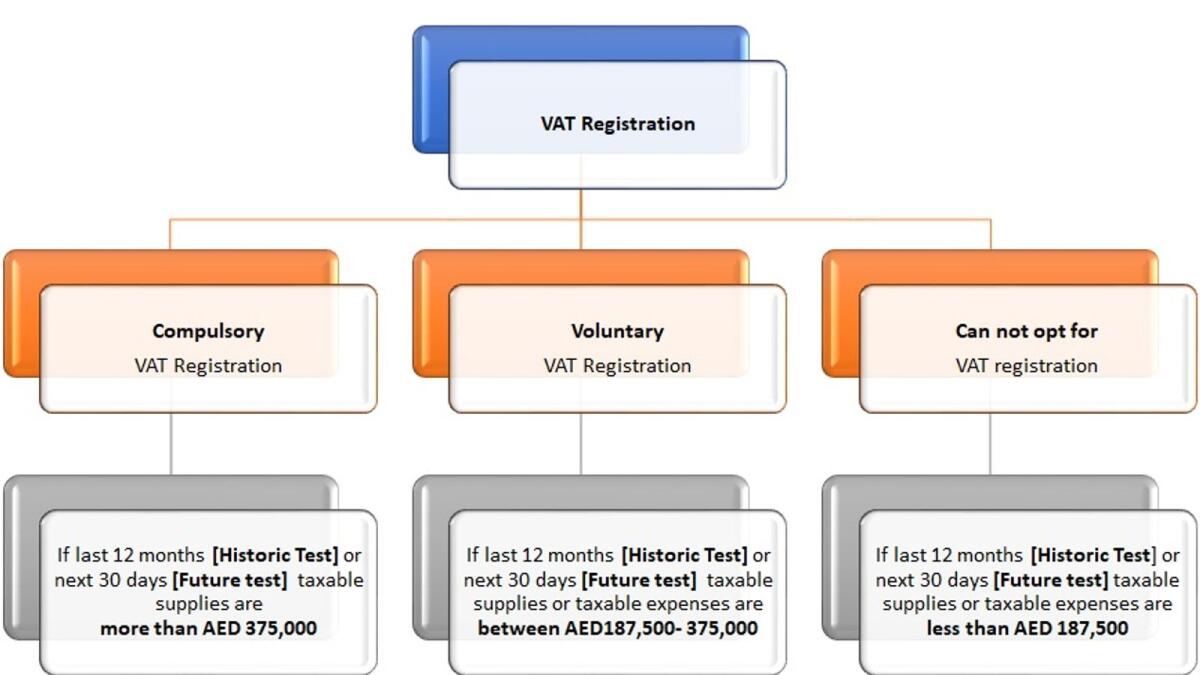

Not all businesses need to register for VAT. Here is who needs to register:

- Businesses with taxable supplies over AED 375,000 per year.

- Businesses with taxable supplies between AED 187,500 and AED 375,000 can register voluntarily.

- Businesses importing goods into the UAE.

Steps to Register for VAT in UAE

Follow these simple steps to register for VAT in the UAE:

Step 1: Create An E-services Account

Visit the Federal Tax Authority (FTA) website. Create an e-Services account using your email.

Step 2: Log In To Your Account

Once your account is created, log in using your credentials.

Step 3: Access The Vat Registration Form

In your account, find the VAT registration form. Click on it to start the process.

Step 4: Fill In Your Details

Provide all necessary details. These include:

- Business information

- Owner details

- Contact information

- Financial details

Step 5: Submit The Form

Double-check all details. Click on the submit button to send your form.

Documents Needed for VAT Registration

Prepare the following documents:

- Trade license copy

- Passport copy of the business owner

- Emirates ID copy of the business owner

- Proof of business address

- Bank account details

- Financial statements

Credit: medium.com

Processing Time and Approval

After submission, FTA reviews your application. It may take up to 20 business days. Once approved, you will receive your Tax Registration Number (TRN).

Benefits of VAT Registration

VAT registration offers several benefits:

- Compliance with UAE law

- Ability to claim VAT refunds

- Improved business credibility

Common Mistakes to Avoid

Avoid these mistakes during VAT registration:

- Providing incorrect information

- Missing required documents

- Delaying the registration process

Frequently Asked Questions

What Is Vat Registration In Uae?

VAT registration in UAE is the process of registering a business for Value Added Tax with the Federal Tax Authority.

Who Needs To Register For Vat In Uae?

Businesses with taxable supplies exceeding AED 375,000 annually must register for VAT in UAE.

How Long Does Vat Registration Take?

VAT registration in UAE generally takes about 20 business days, depending on the completeness of your application.

What Documents Are Needed For Vat Registration?

You need a trade license, passport copies of owners, and proof of business operations for VAT registration.

Conclusion

VAT registration in the UAE is essential for many businesses. Follow the steps and guidelines to ensure a smooth registration process.

Remember to keep your documents ready and provide accurate information. This will help you avoid any delays or issues.

Ahmed bin Rashid, a seasoned travel enthusiast and visa process expert and the successful Businessman in Dubai. With an LLB from the University of Bolton in 2015, he combines his legal knowledge with his passion for exploration, offering invaluable insights into Business formation and visa processes around the globe. Follow Ahmed’s captivating journeys and expert advice to embark on your unforgettable adventures & Business.