Filing corporate tax in the UAE might seem daunting. But don’t worry! This guide is here to help you. Let’s dive into the process step-by-step.

Understanding Corporate Tax in the UAE

First, it’s important to understand what corporate tax is. Corporate tax is a tax on the profits of a company. In the UAE, this tax is governed by specific laws.

Who Needs To File Corporate Tax?

Not all companies need to file corporate tax. Here is a quick list:

- Companies operating in the UAE

- Branches of foreign companies in the UAE

- Partnerships and joint ventures

Free zone companies may have different rules. Always check specific regulations for your zone.

Necessary Documents

Before you start, gather all required documents. These include:

- Financial statements

- Bank statements

- Invoices and receipts

- Previous tax returns

Having these ready will make the process smoother.

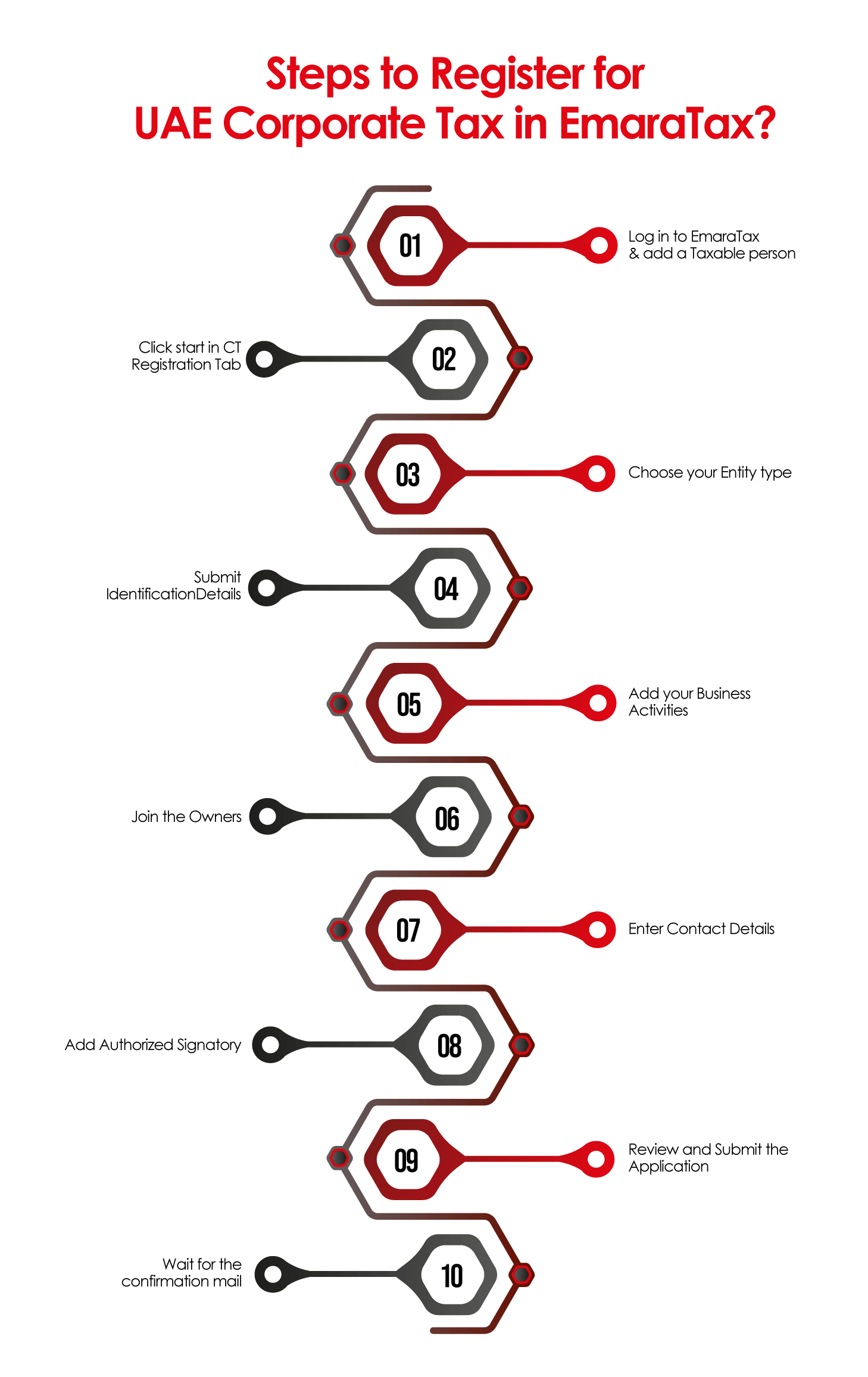

Steps to File Corporate Tax in the UAE

Now, let’s go through the steps to file your corporate tax.

1. Register With The Federal Tax Authority (fta)

First, register your company with the FTA. Visit the FTA website to begin the registration process. Fill out the form with accurate details.

2. Keep Accurate Records

Maintaining accurate records is crucial. This includes all financial transactions. Use accounting software to help with this task.

3. Calculate Taxable Income

Next, calculate your taxable income. Subtract your business expenses from your total revenue. This will give you the taxable income.

4. Apply Deductions

Apply any allowable deductions. These can include:

- Business expenses

- Depreciation

- Losses from previous years

5. Fill Out The Tax Return Form

Once you have all information, fill out the tax return form. You can find this form on the FTA website. Make sure to fill it out accurately.

6. Submit The Tax Return Form

After filling out the form, submit it online. Ensure you submit it before the deadline. Late submissions can result in penalties.

7. Pay The Tax Due

After submitting the form, pay the tax due. You can do this through the FTA portal. Make sure to keep a receipt of the payment.

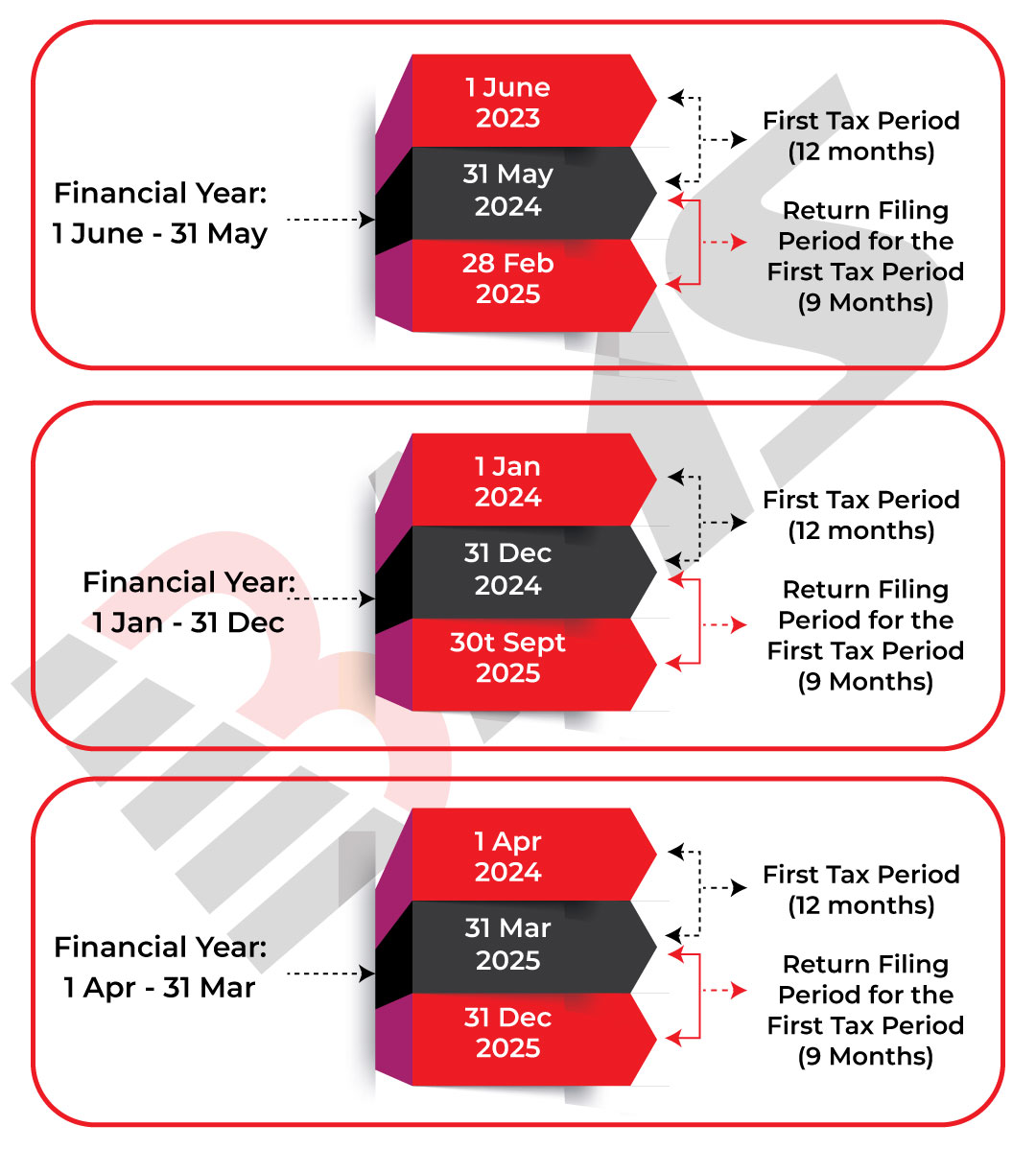

Important Deadlines

Mark these important deadlines on your calendar:

| Action | Deadline |

|---|---|

| Register with FTA | Within 30 days of starting business |

| File Tax Return | Within 120 days of the end of the financial year |

| Pay Tax Due | Within 120 days of the end of the financial year |

Credit: www.bmsauditing.com

Penalties for Late Filing

Filing late can lead to penalties. Here are some common penalties:

- Late submission of tax return: AED 1,000 for the first time

- Late payment of tax due: 1% daily penalty on the unpaid amount

- Errors in tax return: AED 500 for the first time

Avoid these penalties by filing on time.

Common Mistakes to Avoid

Avoid these common mistakes when filing corporate tax:

- Incorrect financial records

- Missing deadlines

- Not applying allowable deductions

- Errors in tax return form

Double-check your work to avoid these errors.

Seeking Professional Help

Filing corporate tax can be complex. If you need help, consider hiring a tax professional. They can guide you through the process and ensure everything is correct.

Credit: corporatetaxuae.com

Frequently Asked Questions

What Are The Uae Corporate Tax Rates?

UAE corporate tax rates are typically 0% for most businesses, with specific exceptions.

Who Must File Corporate Tax In Uae?

All UAE-based companies generating income must file corporate tax returns.

When Is The Corporate Tax Filing Deadline?

The corporate tax filing deadline in UAE is usually six months after the fiscal year ends.

How To Register For Corporate Tax In Uae?

Register for corporate tax in the UAE through the Federal Tax Authority (FTA) portal.

Conclusion

Filing corporate tax in the UAE is an important task. Follow these steps to ensure a smooth process. Remember to keep accurate records and meet deadlines. If in doubt, seek professional help. Happy filing!

Ahmed bin Rashid, a seasoned travel enthusiast and visa process expert and the successful Businessman in Dubai. With an LLB from the University of Bolton in 2015, he combines his legal knowledge with his passion for exploration, offering invaluable insights into Business formation and visa processes around the globe. Follow Ahmed’s captivating journeys and expert advice to embark on your unforgettable adventures & Business.