Getting a UAE VAT certificate is important for businesses. It proves that you are registered for VAT. Follow these steps to get your VAT certificate.

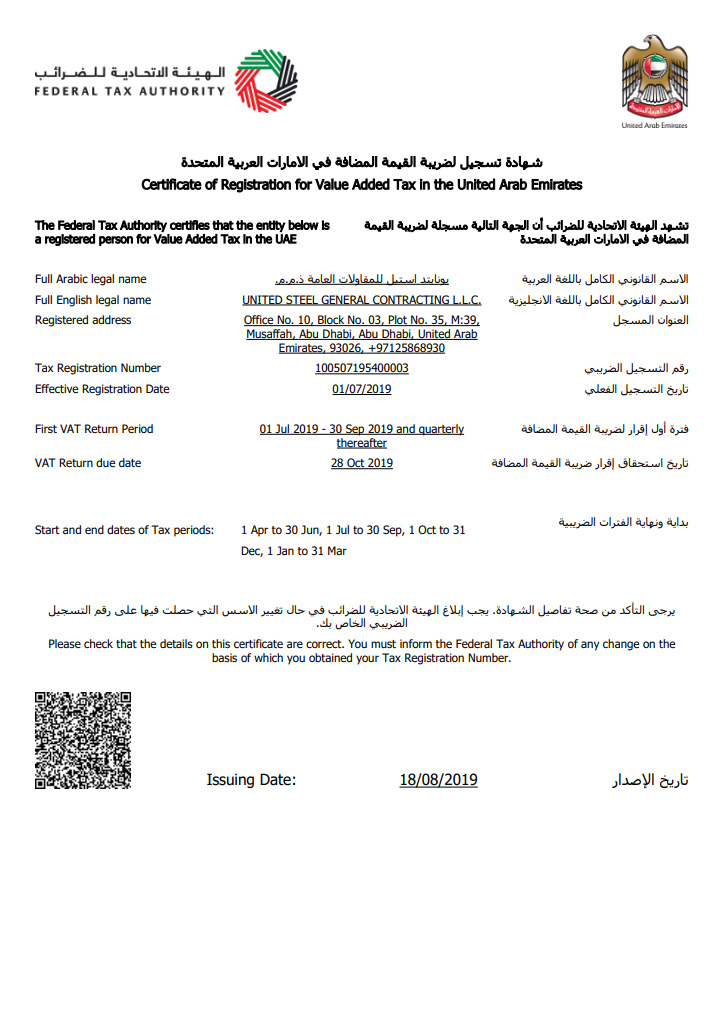

Credit: www.unitedsteel.ae

What is a VAT Certificate?

A VAT certificate is a document. It confirms that your business is registered for VAT. VAT stands for Value Added Tax.

Why Do You Need a VAT Certificate?

A VAT certificate is essential for several reasons:

- It shows that your business complies with UAE tax laws.

- It allows you to collect VAT from your customers.

- It helps you reclaim VAT on business expenses.

Steps to Get UAE VAT Certificate

Follow these steps to get your UAE VAT certificate:

Step 1: Check Eligibility

First, check if your business needs to register for VAT. In the UAE, businesses with an annual turnover of more than AED 375,000 must register for VAT. Some businesses with a turnover between AED 187,500 and AED 375,000 can register voluntarily.

Step 2: Gather Required Documents

Next, gather the documents you need. These include:

- Trade license

- Passport copy of the owner

- Emirates ID copy of the owner

- Proof of business address

- Bank account details

- Financial statements

Step 3: Create An E-services Account

Go to the Federal Tax Authority (FTA) website. Create an e-Services account. You need an email address and a password to create the account.

Step 4: Complete The Vat Registration Form

Log in to your e-Services account. Complete the VAT registration form. Provide accurate information. Double-check your details before submitting the form.

Step 5: Submit Your Application

Submit your completed VAT registration form. The FTA will review your application. They may ask for additional information or documents.

Step 6: Receive Your Vat Certificate

If your application is approved, you will receive your VAT certificate. The FTA will send it to your registered email address. Keep it safe. You may need to show it to customers and suppliers.

Frequently Asked Questions

1. How Long Does It Take To Get A Vat Certificate?

It usually takes a few weeks. The FTA needs time to review your application.

2. Do I Need To Renew My Vat Certificate?

No, you do not need to renew it. But you must keep your business details up to date with the FTA.

3. What Happens If I Don’t Register For Vat?

You may face fines and penalties. It is important to register if your business meets the criteria.

4. Can I Register For Vat Voluntarily?

Yes, if your turnover is between AED 187,500 and AED 375,000, you can register voluntarily.

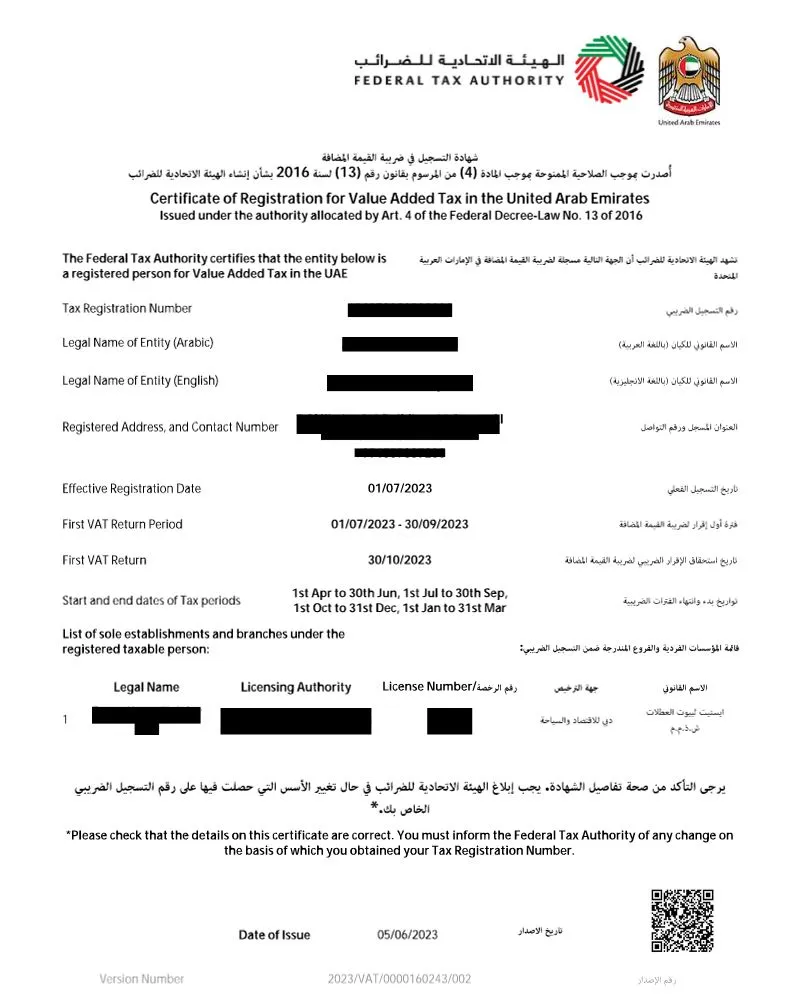

Credit: nowconsultant.com

Benefits of Having a VAT Certificate

Having a VAT certificate has many benefits:

- Builds trust with customers and suppliers

- Allows you to collect VAT on sales

- Helps you reclaim VAT on business expenses

- Ensures compliance with UAE tax laws

Frequently Asked Questions

What Is A Uae Vat Certificate?

A UAE VAT Certificate is a document proving VAT registration.

Why Do I Need A Uae Vat Certificate?

It validates your business’s VAT registration status in the UAE.

How To Apply For A Vat Certificate?

Apply online through the Federal Tax Authority’s (FTA) portal.

What Documents Are Needed For Vat Registration?

You need a trade license, passport copy, and Emirates ID.

Conclusion

Getting a UAE VAT certificate is crucial for businesses. Follow the steps outlined in this guide. Ensure you meet all requirements. This will help you stay compliant with UAE tax laws.

For more information, visit the Federal Tax Authority website.

Ahmed bin Rashid, a seasoned travel enthusiast and visa process expert and the successful Businessman in Dubai. With an LLB from the University of Bolton in 2015, he combines his legal knowledge with his passion for exploration, offering invaluable insights into Business formation and visa processes around the globe. Follow Ahmed’s captivating journeys and expert advice to embark on your unforgettable adventures & Business.