VAT, or Value Added Tax, is a tax on goods and services. In the UAE, some businesses and individuals and diplomats can get a VAT exemption certificate. This means they do not have to pay VAT. This guide will show you how to get vat exemption certificate in the UAE.

Who Can Get a VAT Exemption Certificate?

Not everyone can get a VAT exemption certificate. Here are the main groups who can apply:

- Government bodies

- Charities

- Diplomatic missions

- Some educational institutions

- Healthcare services

If you are in one of these groups, you may be able to get a VAT exemption certificate.

Required Documents for Exemption

The required documents for VAT exemption based on the UAE Ministry of Foreign Affairs website include:

- A diplomatic memorandum.

- A copy of the passport.

- A copy of the Diplomatic ID card.

For more details, you can refer to the respective pages:

Application Timeline and Fees

From the UAE Ministry of Foreign Affairs:

- Application Timeline: Typically, VAT exemption requests are processed within 5 business days.

- Fees: No application fees are mentioned for the tax exemption service.

From the Dubai Development Authority (DDA):

- Application Timeline: The DDA does not provide a specific timeline for processing VAT exemption letters but mentions that all services are handled promptly.

- Fees: Application fees are AED 500.

For more details, visit the UAE Ministry of Foreign Affairs and DDA.

How to Get a VAT Exemption Certificate in UAE: Step by Step

If you’re a diplomat or international organization in the UAE, applying for a VAT exemption certificate can help you avoid unnecessary taxes. Here’s a comprehensive guide on how to apply for a VAT exemption through the UAE Ministry of Foreign Affairs (MOFA):

Step 1: Gather Required Documents

To start, you’ll need:

- A diplomatic memorandum.

- A copy of your passport.

- A copy of your diplomatic ID card.

These documents prove your eligibility for tax exemption in the UAE.

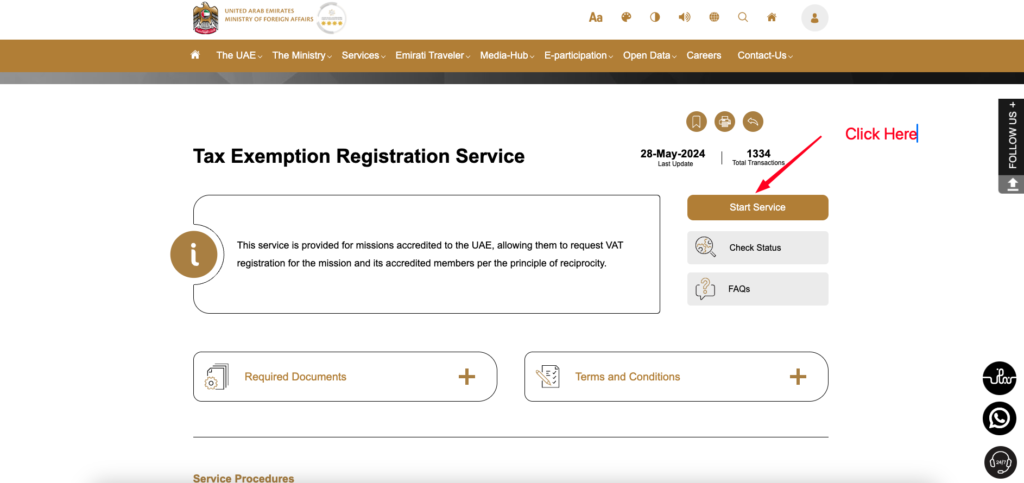

Step 2: Access the MOFA Portal

Head to the official MOFA VAT Exemption Registration Service. This is where you’ll complete your VAT exemption application online.

Step 3: Complete the Application Form

Fill out the online form on the portal. Ensure all your information is accurate, as errors can lead to delays in processing.

Step 4: Upload the Required Documents

You will be prompted to upload the diplomatic memorandum, passport copy, and diplomatic ID. Make sure these documents are clear and comply with the portal’s size and format requirements.

Step 5: Submit the Application

Once your form is complete and the documents are uploaded, submit your application. You’ll receive a confirmation once it’s processed successfully.

Step 6: Processing Time

The processing of your VAT exemption request typically takes around 5 business days. You will be notified via email once your application has been reviewed and approved.

Step 7: Receive Your VAT Exemption Certificate

After approval, you can download your VAT exemption certificate directly from the MOFA portal. This certificate is proof of your VAT-exempt status in the UAE.

Terms and Conditions for VAT exemption:

- Embassies and diplomats are registered based on reciprocity, while international organizations follow the Seat Agreement.

- Refunds are processed quarterly by the Federal Tax Authority, requiring at least 25 working days for completion after submitting documentation.

- Invoices must have a minimum value of AED 200.

- Refunds for missions are deposited into local bank accounts, with no cash refunds.

This streamlined process ensures clarity for missions and diplomats when handling VAT exemptions.

Frequently Asked Questions

What Is A Vat Exemption Certificate?

A VAT exemption certificate allows eligible businesses to be exempt from paying VAT on certain goods and services.

Who Is Eligible For Vat Exemption In Uae?

Businesses involved in exports, international transport, and certain health and education services are eligible for VAT exemption in the UAE.

How To Apply For A Vat Exemption Certificate?

Apply online through the Federal Tax Authority (FTA) portal by submitting required documents and completing the application form.

What Documents Are Needed For Vat Exemption?

Required documents include trade license, proof of business activity, and financial statements.

Read Related Article:

UAE Vat Law

Percentage of vat in UAE

How to Get VAT Refund in UAE

How to do VAT Registration in UAE

Ahmed bin Rashid, a seasoned travel enthusiast and visa process expert and the successful Businessman in Dubai. With an LLB from the University of Bolton in 2015, he combines his legal knowledge with his passion for exploration, offering invaluable insights into Business formation and visa processes around the globe. Follow Ahmed’s captivating journeys and expert advice to embark on your unforgettable adventures & Business.