Are you looking to open a savings account in Rak Bank? Opening a savings account is a smart financial move that can help you save for your future goals and secure your financial stability. In this blog post, we will guide you through the process of opening a savings account in Rak Bank, step by step. Let’s get started!

Step 1: Do Your Research

The first step in opening a savings account in Rak Bank is to do your research. Start by visiting the Rak Bank website and explore the different types of savings accounts they offer. Take into consideration factors such as interest rates, minimum balance requirements, and any additional features or benefits that may be offered.

It’s also a good idea to compare Rak Bank’s savings account offerings with other banks to ensure you are getting the best possible deal. Look for accounts that offer competitive interest rates and low fees.

Step 2: Gather Required Documents

Once you have decided on the type of savings account you want to open, it’s time to gather the required documents. Typically, you will need the following documents:

- Valid Emirates ID

- Passport with a valid residency visa for expatriates

- Proof of address (such as a utility bill or rental agreement)

Make sure to have these documents readily available before proceeding to the next step.

Step 3: Visit a Rak Bank Branch

With your required documents in hand, visit a Rak Bank branch near you. Approach the customer service desk and let them know that you would like to open a savings account. They will provide you with the necessary application forms and guide you through the process.

Take your time to carefully fill out the application forms, ensuring that all information provided is accurate and up to date. Any mistakes or discrepancies may delay the account opening process.

Step 4: Submit Your Application

After filling out the application forms, submit them along with the required documents to the customer service representative. They will review your application and documents to ensure everything is in order.

At this stage, it’s a good idea to ask any questions you may have about the savings account, such as the interest rate, fees, or any additional services offered by Rak Bank. The customer service representative will be able to provide you with all the information you need.

Credit: www.youtube.com

Step 5: Deposit the Initial Amount

Once your application is approved, you will need to deposit the initial amount required to open the savings account. The amount may vary depending on the type of savings account you have chosen and the bank’s policies.

You can make the initial deposit in cash or through a check. The customer service representative will guide you on how to proceed with the deposit.

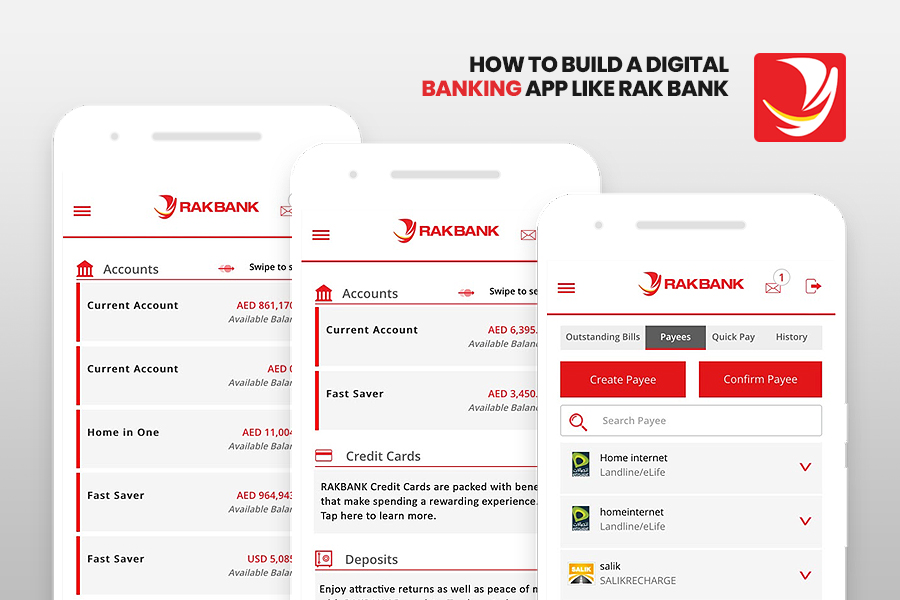

Credit: usmsystems.com

Step 6: Activate Your Account

After depositing the initial amount, your savings account will be activated. You will receive a welcome kit containing important information about your account, such as your account number, debit card, and online banking details.

It’s important to activate your online banking account as soon as possible to take advantage of the convenience and security it offers. Follow the instructions provided in the welcome kit to set up your online banking account.

Step 7: Start Saving!

Congratulations! You have successfully opened a savings account in Rak Bank. Now it’s time to start saving and making the most of your new account.

Set up automatic transfers from your salary account to your savings account to ensure regular savings. Take advantage of any additional features offered by Rak Bank, such as goal-based savings or round-up options, to maximize your savings potential.

Remember to regularly review your savings account to track your progress towards your financial goals. Make adjustments to your savings strategy as needed to stay on track.

Frequently Asked Questions

How To Open A Savings Account In Rak Bank?

To open a savings account in Rak Bank, visit the nearest branch with the required documents.

What Documents Are Needed To Open A Savings Account In Rak Bank?

You will need a valid passport, Emirates ID, proof of address, and a visa if applicable.

What Are The Benefits Of Opening A Savings Account With Rak Bank?

By opening a savings account with Rak Bank, you can enjoy competitive interest rates and convenient online banking services.

Can Non-residents Open A Savings Account In Rak Bank?

Yes, non-residents can open a savings account in Rak Bank by providing the necessary documents such as passport and visa.

Is There A Minimum Balance Requirement For A Savings Account In Rak Bank?

Yes, there is a minimum balance requirement for a savings account with Rak Bank, which varies based on the type of account.

Conclusion

Opening a savings account in Rak Bank is a straightforward process that can provide you with a secure and convenient way to save for your future. By following the steps outlined in this blog post, you can open a savings account with Rak Bank and start your journey towards financial stability and success.

Remember to do your research, gather the required documents, visit a Rak Bank branch, submit your application, deposit the initial amount, activate your account, and start saving!

If you have any further questions or need assistance, don’t hesitate to reach out to Rak Bank’s customer service. They will be more than happy to help you.

Ahmed bin Rashid, a seasoned travel enthusiast and visa process expert and the successful Businessman in Dubai. With an LLB from the University of Bolton in 2015, he combines his legal knowledge with his passion for exploration, offering invaluable insights into Business formation and visa processes around the globe. Follow Ahmed’s captivating journeys and expert advice to embark on your unforgettable adventures & Business.