If you’re a resident of the United Arab Emirates (UAE) or planning to move there, you may be wondering about the best credit card options available to you. With a wide range of financial institutions and credit card providers in the UAE, choosing the right credit card can be overwhelming. To help you make an informed decision, we’ve compiled a comprehensive guide to the best credit cards in the UAE.

Factors to Consider When Choosing a Credit Card in UAE

Before diving into the specific credit card options, it’s essential to consider the factors that matter when choosing a credit card in the UAE. Some of the key factors to consider include:

- Annual Fees

- Interest Rates

- Rewards and Benefits

- Travel Benefits

- Cashback Offers

- Customer Service

- Acceptance and Coverage

- Additional Features

Keeping these factors in mind, let’s explore some of the best credit cards available in the UAE.

1. Emirates NBD Skywards Infinite Credit Card

The Emirates NBD Skywards Infinite Credit Card is a popular choice for frequent travelers and individuals looking to maximize their travel rewards. With this card, you can earn Skywards Miles on your everyday spending, which can be redeemed for flights, upgrades, and more. Additionally, cardholders can enjoy complimentary airport lounge access, travel insurance, and other exclusive travel benefits.

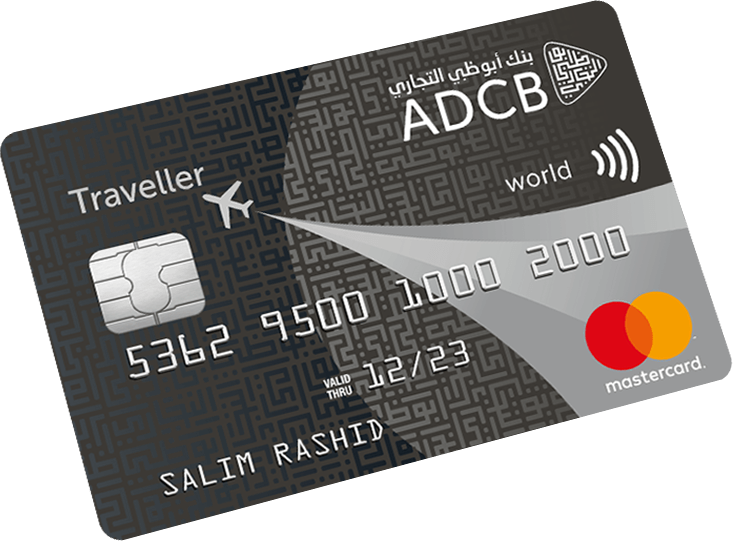

2. ADCB Traveller Credit Card

For individuals who prioritize travel benefits and rewards, the ADCB Traveller Credit Card is a compelling option. Cardholders can earn Etihad Guest Miles on their purchases, along with access to airport lounges, travel insurance, and exclusive discounts on flights and hotel bookings. The card also offers attractive sign-up bonuses and accelerated earning potential on specific spending categories.

3. Mashreq Solitaire Credit Card

Designed for luxury and lifestyle enthusiasts, the Mashreq Solitaire Credit Card offers a host of exclusive benefits, including access to premium lifestyle experiences, concierge services, and personalized rewards. Cardholders can also enjoy complimentary airport lounge access, travel insurance, and dining privileges at select restaurants. The card is well-suited for individuals seeking a premium credit card experience.

4. Citi Cashback Credit Card

For those focused on earning cashback rewards on their spending, the Citi Cashback Credit Card is a standout option. Cardholders can earn cashback on their everyday purchases, including groceries, dining, and utility bills. The card also offers attractive sign-up bonuses, fuel surcharge waivers, and additional savings through Citi World Privileges.

5. RAKBANK Titanium Credit Card

The RAKBANK Titanium Credit Card is a versatile option that caters to a wide range of spending habits. With this card, users can earn rewards points on their purchases, which can be redeemed for flights, hotel stays, and shopping vouchers. The card also offers dining discounts, purchase protection, and easy payment plans for large transactions.

6. HSBC Black Credit Card

As a premium credit card offering, the HSBC Black Credit Card is designed to provide exclusive benefits and privileges to its cardholders. With this card, individuals can enjoy access to VIP airport lounges, golf privileges, travel insurance, and accelerated rewards on specific spending categories. The card also comes with personalized services and round-the-clock concierge assistance.

7. FAB Visa Infinite Credit Card

The FAB Visa Infinite Credit Card is tailored for high-net-worth individuals and frequent travelers seeking premium benefits and rewards. Cardholders can earn Etihad Guest Miles or Emirates Skywards Miles on their spending, along with access to airport lounges, travel insurance, and complimentary golf rounds. The card also provides exclusive lifestyle privileges and concierge services.

Choosing the Right Credit Card for You

With the diverse range of credit cards available in the UAE, it’s crucial to assess your spending habits, lifestyle preferences, and financial goals when choosing a credit card. Whether you prioritize travel benefits, cashback rewards, or luxury experiences, there’s a credit card in the UAE that aligns with your needs. By carefully evaluating the features and benefits of each card, you can make an informed decision that complements your lifestyle and maximizes your financial well-being.

Conclusion

When it comes to selecting the best credit card in the UAE, there’s no one-size-fits-all solution. The ideal credit card for you depends on your individual preferences, spending patterns, and financial objectives. By considering the annual fees, interest rates, rewards, and additional benefits offered by each credit card, you can identify the card that best aligns with your lifestyle and financial goals. Whether you’re a frequent traveler, a cashback enthusiast, or a luxury connoisseur, the UAE’s diverse credit card options have something to offer for everyone.

Before applying for a credit card, it’s advisable to review the terms and conditions, as well as the eligibility criteria, to ensure that you select a card that suits your needs and financial situation. With the right credit card in your wallet, you can make the most of your spending, enjoy exclusive privileges, and work towards achieving your financial aspirations in the vibrant landscape of the United Arab Emirates.

Ahmed bin Rashid, a seasoned travel enthusiast and visa process expert and the successful Businessman in Dubai. With an LLB from the University of Bolton in 2015, he combines his legal knowledge with his passion for exploration, offering invaluable insights into Business formation and visa processes around the globe. Follow Ahmed’s captivating journeys and expert advice to embark on your unforgettable adventures & Business.