Excise tax is a type of tax levied on specific goods. These goods are often harmful to health or the environment. In the UAE, excise tax aims to reduce consumption of these products.

Why Was Excise Tax Introduced in the UAE?

The UAE government introduced excise tax to promote a healthier lifestyle. It also aims to reduce the financial burden of healthcare services.

Health Concerns

Many excise goods are harmful to health. For example, tobacco products can cause serious illnesses.

Environmental Concerns

Some excise goods can harm the environment. By taxing them, the UAE aims to protect the planet.

Which Products Are Subject to Excise Tax?

Excise tax in the UAE applies to several categories of products.

| Product Category | Tax Rate |

|---|---|

| Tobacco Products | 100% |

| Energy Drinks | 100% |

| Carbonated Drinks | 50% |

| Sweetened Drinks | 50% |

As you can see, the tax rates are quite high. This is to discourage people from buying these products.

How Does Excise Tax Affect Consumers?

Excise tax affects consumers in several ways.

- Higher Prices: Excise tax increases the price of goods.

- Healthier Choices: People may choose healthier options to avoid paying more.

Let’s look at an example. If you buy a can of energy drink, you will pay 100% more because of the excise tax.

How Does Excise Tax Affect Businesses?

Businesses that sell excise goods need to follow certain rules.

Registration

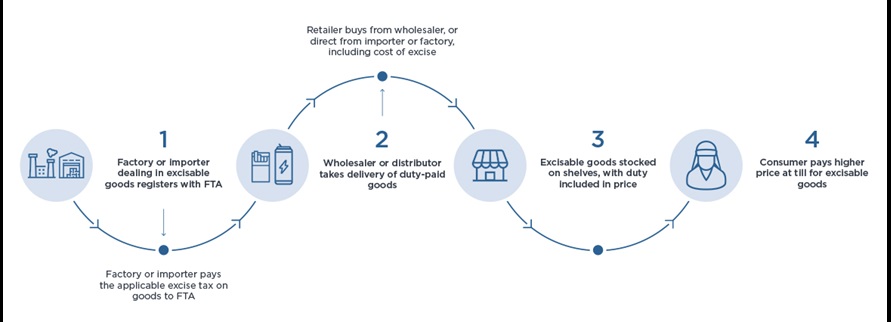

Businesses must register with the Federal Tax Authority (FTA). This is mandatory for all businesses dealing with excise goods.

Filing Returns

Businesses must file excise tax returns. This is usually done every month. The returns must include details of all excise goods sold.

Payment

Businesses must pay the excise tax they collect to the government. This is done through the FTA’s online portal.

How Is Excise Tax Calculated?

Excise tax is calculated based on the retail selling price of the goods. The retail selling price includes all costs, profits, and taxes. Here’s a simple example:

| Product | Retail Price (AED) | Excise Tax Rate | Excise Tax (AED) |

|---|---|---|---|

| Energy Drink | 10 | 100% | 10 |

| Carbonated Drink | 5 | 50% | 2.5 |

In this example, if you buy an energy drink for 10 AED, you will pay an additional 10 AED as excise tax.

Credit: www.allaboutvat.com

Credit: rtaccountant.com

Exemptions and Refunds

Some goods are exempt from excise tax. There are also cases where refunds can be claimed.

Exemptions

Certain products may be exempt from excise tax. For example, goods sold for international travel may be exempt.

Refunds

Businesses can claim refunds in some cases. This is usually when goods are exported outside the UAE.

Frequently Asked Questions

What Is Excise Tax In Uae?

Excise Tax in UAE is a form of indirect tax imposed on specific goods that are harmful to human health or the environment.

Which Products Are Subject To Excise Tax?

Products like tobacco, energy drinks, and carbonated beverages are subject to Excise Tax in the UAE.

How Much Is The Excise Tax Rate?

The Excise Tax rate is typically 50% on carbonated drinks and 100% on tobacco and energy drinks.

Who Needs To Register For Excise Tax?

Businesses that import, produce, or stockpile excise goods must register for Excise Tax in the UAE.

Conclusion

Excise tax in the UAE aims to promote health and protect the environment. It affects both consumers and businesses. Understanding how it works can help you make informed choices.

If you have any questions, feel free to contact the Federal Tax Authority for more information. This will help you stay compliant and make better decisions.

Ahmed bin Rashid, a seasoned travel enthusiast and visa process expert and the successful Businessman in Dubai. With an LLB from the University of Bolton in 2015, he combines his legal knowledge with his passion for exploration, offering invaluable insights into Business formation and visa processes around the globe. Follow Ahmed’s captivating journeys and expert advice to embark on your unforgettable adventures & Business.