RCM stands for Reverse Charge Mechanism. It is a part of the VAT system in the UAE. Let’s explore what RCM is and how it works.

Understanding RCM

RCM means the buyer pays the VAT instead of the seller. This is different from the usual process. Normally, sellers collect VAT from buyers and pay it to the government.

Why Rcm Exists

RCM helps stop tax evasion. It also makes the tax system simpler. It is used in special cases where the seller is not in the UAE.

When is RCM Applied?

RCM is applied in certain situations. Here are some common cases:

- Importing goods to the UAE

- Importing services to the UAE

- Buying gold and diamonds

- Purchasing certain real estate services

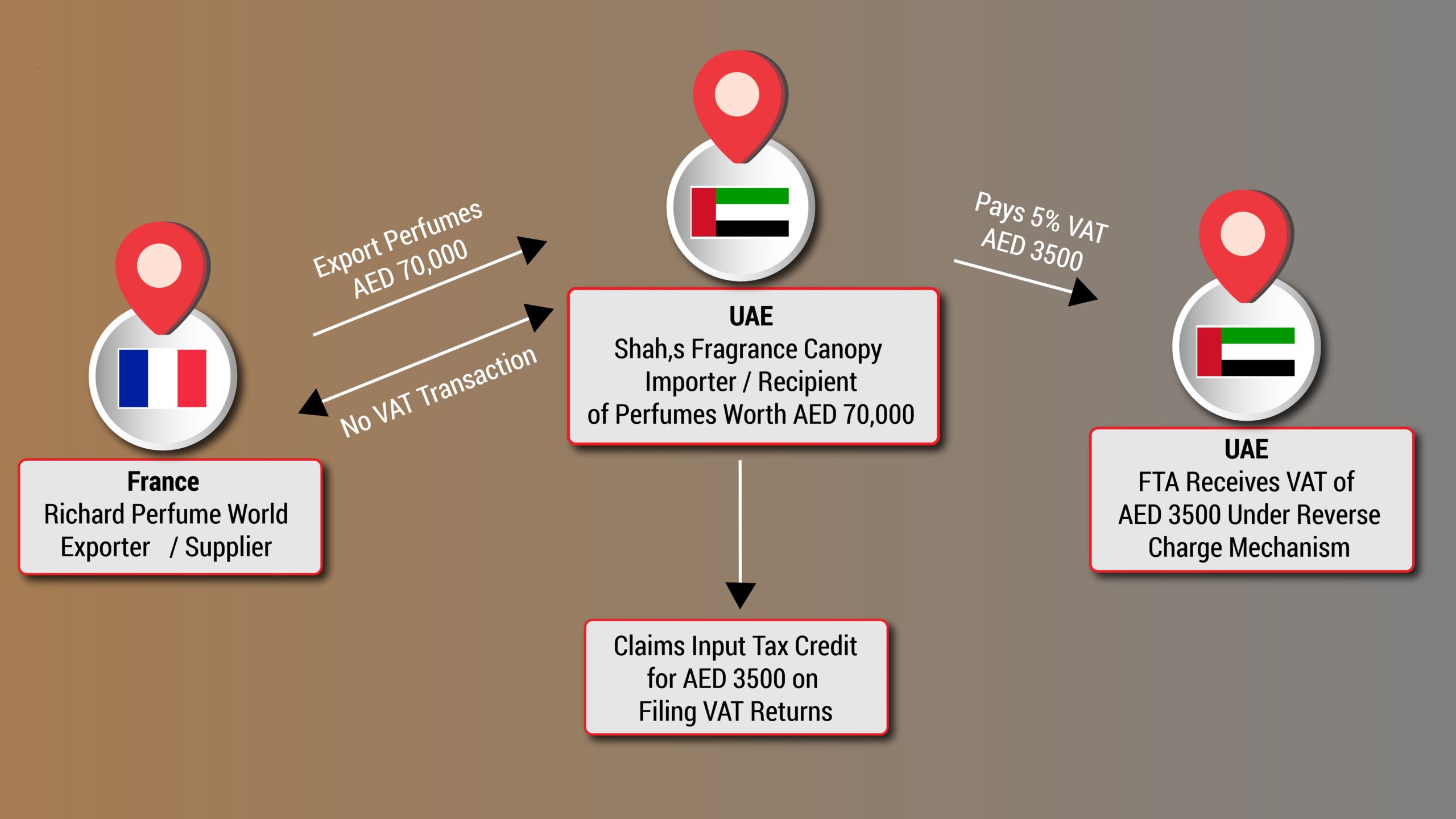

Importing Goods

When goods are imported, the buyer pays VAT. This is done under RCM. The seller does not pay VAT in this case.

Importing Services

When services are imported, the buyer also pays VAT. This follows the RCM rule too.

Gold And Diamonds

Special rules apply to gold and diamonds. RCM is used to make sure VAT is paid correctly.

Real Estate Services

Certain real estate services use RCM. This helps to ensure VAT is collected properly.

Benefits of RCM

RCM has many benefits. Here are a few:

- Prevents tax evasion

- Makes the tax system simpler

- Ensures proper VAT collection

- Helps small businesses

Prevents Tax Evasion

RCM makes it harder to avoid paying taxes. This helps the government collect more revenue.

Makes The Tax System Simpler

With RCM, the tax system is easier to manage. This is because fewer parties are involved.

Ensures Proper Vat Collection

RCM ensures VAT is collected correctly. This is especially important for international transactions.

Helps Small Businesses

RCM can help small businesses by reducing their tax burden. This allows them to grow and thrive.

Credit: discuss.frappe.io

How to Comply with RCM

Businesses need to follow some steps to comply with RCM. Here is a simple guide:

Step 1: Identify Transactions Subject To Rcm

Businesses must know which transactions fall under RCM. This helps them apply the correct rules.

Step 2: Calculate Vat

Next, businesses need to calculate the VAT. This is usually a percentage of the transaction value.

Step 3: Report Vat

Businesses must report VAT in their tax returns. This ensures they comply with the law.

Step 4: Pay Vat

Finally, businesses need to pay the VAT. This is done through the government’s tax system.

Common Mistakes to Avoid

There are some common mistakes businesses should avoid. Here are a few:

- Not identifying RCM transactions

- Incorrectly calculating VAT

- Failing to report VAT

- Not paying VAT on time

Not Identifying Rcm Transactions

Businesses must know which transactions use RCM. Failing to do so can lead to penalties.

Incorrectly Calculating Vat

Calculating VAT incorrectly can cause issues. Businesses should double-check their calculations.

Failing To Report Vat

Businesses must report VAT in their tax returns. Not doing so can lead to fines.

Not Paying Vat On Time

Paying VAT late can result in penalties. Businesses should ensure they pay on time.

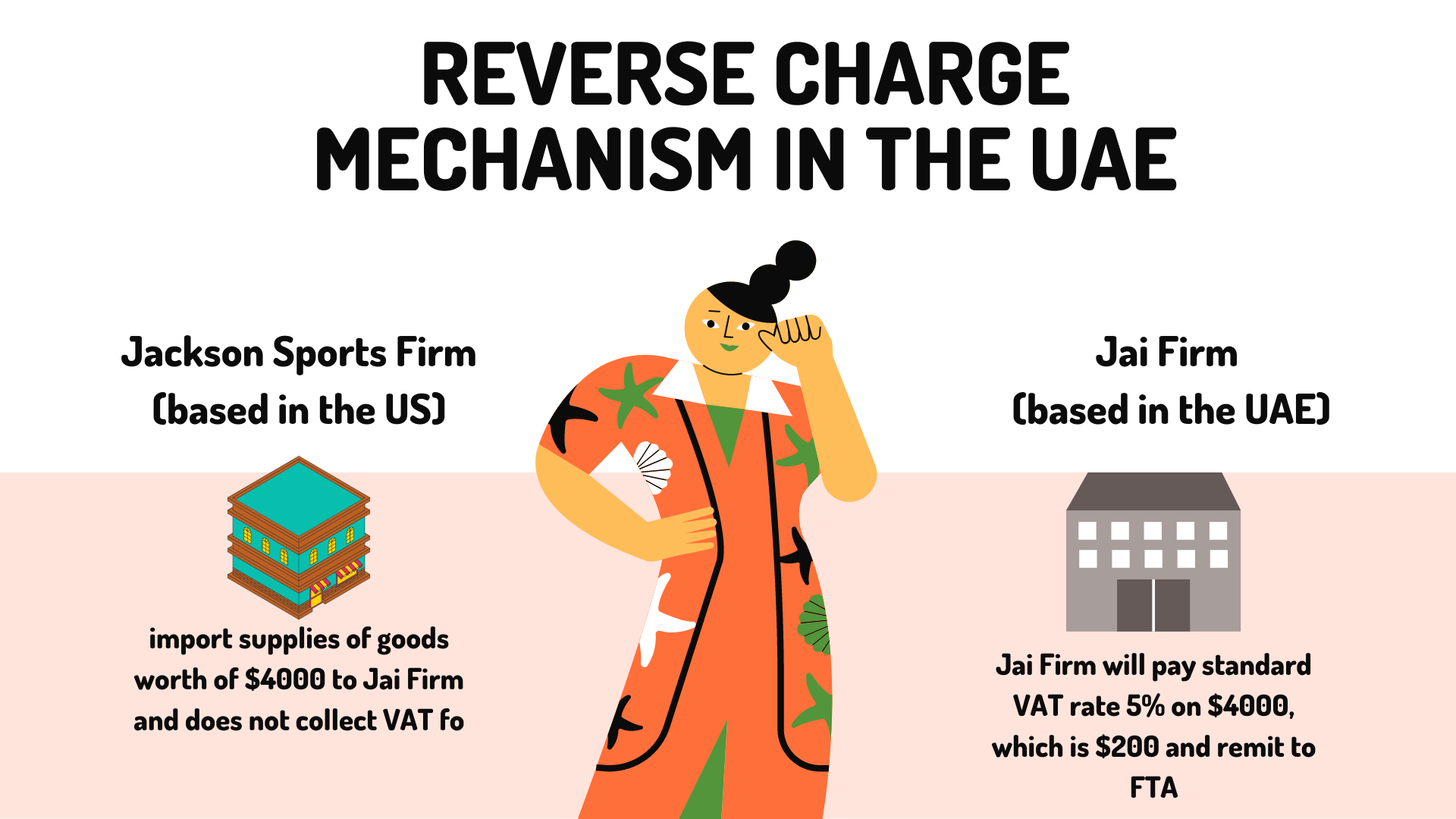

Credit: www.deskera.com

Frequently Asked Questions

What Is Rcm In Vat Uae?

RCM (Reverse Charge Mechanism) shifts the VAT liability from the seller to the buyer in UAE.

How Does Rcm Work In Uae?

Under RCM, the buyer reports and pays VAT directly to the government instead of the seller.

Who Is Affected By Rcm In Uae?

Businesses importing goods or services from abroad are primarily affected by RCM in UAE.

Why Is Rcm Important In Uae Vat?

RCM ensures tax compliance and prevents tax evasion in cross-border transactions.

Conclusion

RCM is an important part of the VAT system in the UAE. It helps prevent tax evasion and makes the system simpler. Businesses need to understand and comply with RCM rules. This will help them avoid penalties and ensure proper VAT collection.

By following the steps and avoiding common mistakes, businesses can easily comply with RCM. This will help them grow and succeed in the UAE market.

Ahmed bin Rashid, a seasoned travel enthusiast and visa process expert and the successful Businessman in Dubai. With an LLB from the University of Bolton in 2015, he combines his legal knowledge with his passion for exploration, offering invaluable insights into Business formation and visa processes around the globe. Follow Ahmed’s captivating journeys and expert advice to embark on your unforgettable adventures & Business.