The UAE VAT Law is a tax law in the United Arab Emirates. VAT stands for Value Added Tax. This tax is added to goods and services. The VAT Law was introduced on January 1, 2018.

Why was VAT introduced in the UAE?

The UAE introduced VAT to diversify its revenue sources. The country wants to reduce its dependence on oil. VAT helps the government collect more money. This money is used for public services.

Who needs to pay VAT?

Both businesses and consumers pay VAT. Businesses collect VAT from their customers. They then pay this VAT to the government. Consumers pay VAT when they buy goods or services. The VAT rate in the UAE is 5%.

How does VAT affect businesses?

Businesses must register for VAT if their taxable supplies exceed AED 375,000 per year. They must also keep detailed records of their transactions. These records include invoices and receipts. Businesses must submit VAT returns to the Federal Tax Authority (FTA).

Credit: www.linkedin.com

What are the benefits of VAT for the UAE?

- Increased government revenue

- More funds for public services

- Reduced dependency on oil income

- Improved infrastructure

What are the challenges of VAT for businesses?

Businesses face several challenges due to VAT. These include:

- Keeping accurate records

- Understanding VAT laws and regulations

- Filing VAT returns on time

- Managing cash flow

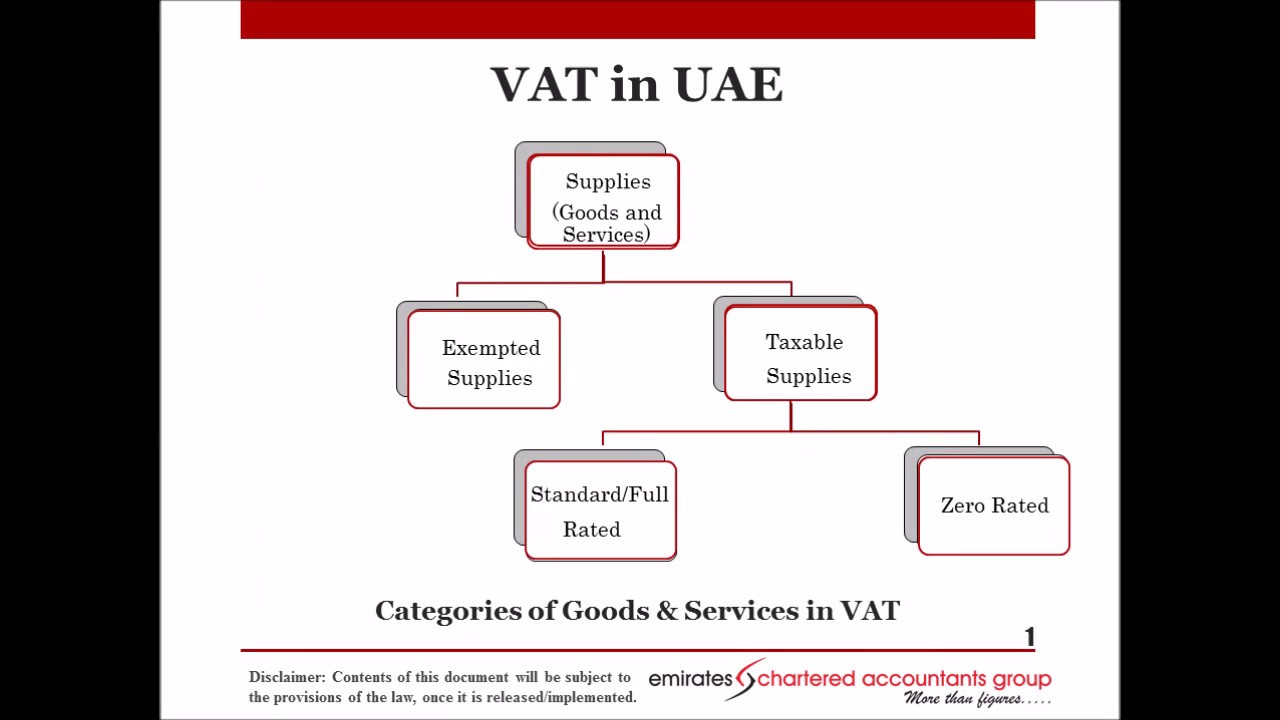

What is exempt from VAT in the UAE?

Not all goods and services are subject to VAT. Some items are exempt. These items include:

- Financial services

- Residential properties

- Local passenger transport

- Bare land

What is zero-rated VAT?

Some goods and services are zero-rated. This means the VAT rate is 0%. Businesses can still claim input tax credits on zero-rated items. Zero-rated items include:

- Healthcare services

- Education services

- Exports of goods and services

- International transportation

How to register for VAT in the UAE?

Businesses must register for VAT through the FTA website. The registration process is simple. Follow these steps:

- Visit the FTA website

- Sign up for an e-Services account

- Complete the VAT registration form

- Submit the required documents

- Receive your VAT registration number

Credit: www.youtube.com

How to file VAT returns?

Businesses must file VAT returns regularly. The filing period is usually quarterly. To file a VAT return, follow these steps:

- Log in to your FTA e-Services account

- Go to the VAT returns section

- Complete the VAT return form

- Submit the form online

- Pay any VAT due to the FTA

Penalties for non-compliance

Businesses must comply with VAT laws. Non-compliance can result in penalties. Penalties include:

- Fines

- Interest on unpaid VAT

- Suspension of business activities

Frequently Asked Questions

What Is Uae Vat Law?

UAE VAT law regulates Value Added Tax on goods and services.

Who Needs To Register For Uae Vat?

Businesses with taxable supplies over AED 375,000 must register.

What Is The Vat Rate In Uae?

The standard VAT rate in UAE is 5%.

Are All Goods Subject To Vat In Uae?

No, some goods are zero-rated or exempt.

Conclusion

The UAE VAT Law is essential for the country’s economy. It helps the government raise revenue. Businesses and consumers both play a role. By understanding VAT, you can comply with the law and avoid penalties.

Ahmed bin Rashid, a seasoned travel enthusiast and visa process expert and the successful Businessman in Dubai. With an LLB from the University of Bolton in 2015, he combines his legal knowledge with his passion for exploration, offering invaluable insights into Business formation and visa processes around the globe. Follow Ahmed’s captivating journeys and expert advice to embark on your unforgettable adventures & Business.