When dealing with financial institutions like banks, terminologies such as “Blocked Amount” may seem confusing at first glance. However, it is important to grasp the concept to ensure a smooth banking experience. In the context of FAB Bank, which stands for First Abu Dhabi Bank in the UAE, understanding what a Blocked Amount entails is crucial.

Credit: www.bankfab.com

What is FAB Bank?

Before diving into the specifics of Blocked Amount, let’s briefly touch upon what FAB Bank is. FAB Bank, also known as First Abu Dhabi Bank, is one of the largest and most prominent banking institutions in the United Arab Emirates. With a wide range of financial services and products, FAB Bank caters to both individual and corporate clients, offering a diverse array of banking solutions.

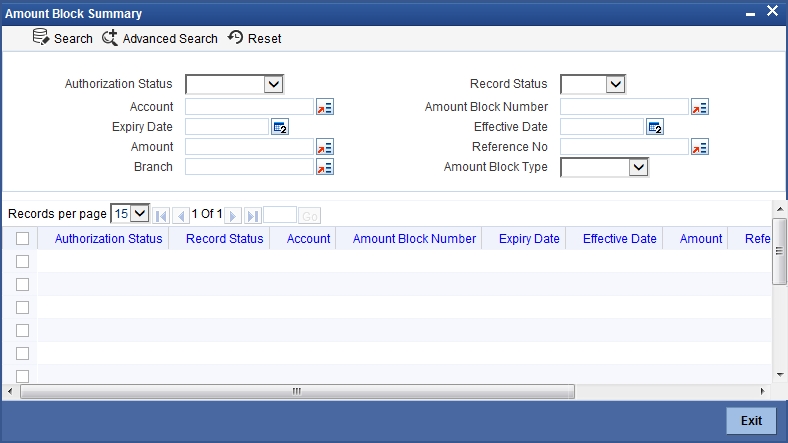

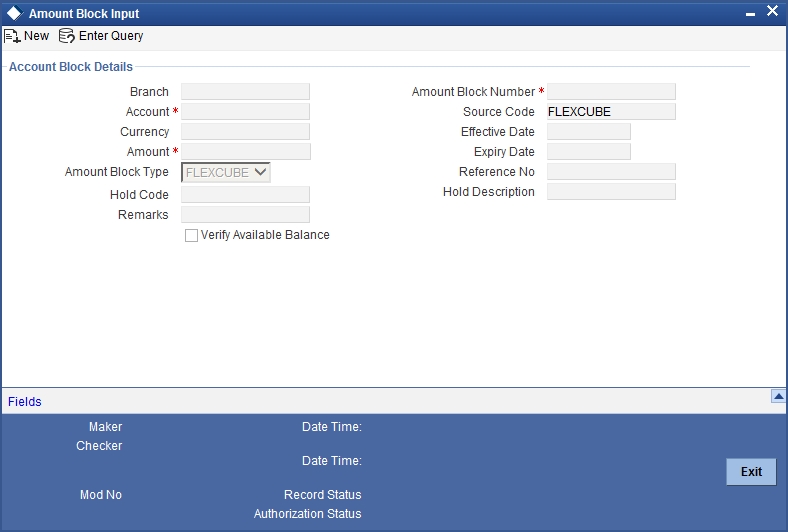

Credit: docs.oracle.com

Definition of Blocked Amount

Blocked Amount refers to a certain sum of money that is held or reserved in an account for a specific purpose. In the context of banking, this amount is typically restricted from being accessed or utilized for regular transactions. The reason for blocking the amount may vary, ranging from security reasons to fulfilling certain obligations.

Reasons For Blocking Amount In Fab Bank

There are several reasons why FAB Bank may block a certain amount in an account. Some common scenarios where an amount may be blocked include:

- Security Purposes: To prevent unauthorized transactions or fraud, FAB Bank may block a certain amount in an account as a security measure.

- Loan Collateral: When applying for a loan, FAB Bank may require you to block a certain amount as collateral until the loan is repaid.

- Guarantee for Services: In some cases, FAB Bank may block an amount as a guarantee for services or transactions that you intend to undertake.

How Blocked Amount Works

When an amount is blocked in your FAB Bank account, it means that the funds are temporarily restricted from being used for regular transactions. While the money is still in your account, you cannot access it until the blocking condition is lifted or fulfilled. Once the purpose for blocking the amount is resolved, the funds are typically released back into your available balance.

Managing Blocked Amount in FAB Bank

It is important to keep track of any blocked amounts in your FAB Bank account to avoid any inconvenience. Here are some tips for managing blocked amounts:

- Stay Informed: Understand the reason why a certain amount is blocked in your account and how long it is expected to be held.

- Plan Finances: Take into account the blocked amount when planning your finances to avoid any unexpected shortages.

- Communicate with the Bank: If you have any questions or concerns regarding a blocked amount, do not hesitate to contact FAB Bank for clarification.

Frequently Asked Questions

What Is A Blocked Amount In Fab Bank?

A blocked amount is a temporary hold on funds for a specific purpose, such as guaranteeing payment for a purchase or service.

How Does A Blocked Amount Work In Fab Bank?

A blocked amount is held in the customer’s account, but cannot be used for other transactions until the hold is released.

Why Does Fab Bank Block An Amount In My Account?

Fab Bank may block an amount to ensure that funds are available for a pending transaction or to guarantee payment for a service.

What Happens To A Blocked Amount In Fab Bank?

The blocked amount in Fab Bank is released once the transaction is completed, or after a specified period, depending on the terms of the hold.

Can I Unblock A Blocked Amount In Fab Bank?

No, you cannot unblock a blocked amount in Fab Bank. It will be automatically released once the transaction is complete or the hold period ends.

Conclusion

In conclusion, Blocked Amount in FAB Bank refers to a sum of money that is restricted from regular use for a specific purpose. Whether it is for security measures, loan collateral, or guarantees, understanding why an amount is blocked is essential for a smooth banking experience. By managing blocked amounts effectively and staying informed, you can navigate your finances with ease at FAB Bank.

Read More About FAB Bank:

Fab Bank Balance Check

How to Get Fab Bank Statement Online

How to Activate Internet Banking in Fab

What is Blocked Amount in FAB Bank

Why Fab Bank Customer Service Struggles

Ahmed bin Rashid, a seasoned travel enthusiast and visa process expert and the successful Businessman in Dubai. With an LLB from the University of Bolton in 2015, he combines his legal knowledge with his passion for exploration, offering invaluable insights into Business formation and visa processes around the globe. Follow Ahmed’s captivating journeys and expert advice to embark on your unforgettable adventures & Business.

Thank you so much for this information..Earlier on my account was involved in Fraud and my money was transacted without my authorization check my online FAB the money is on Hold i raised up a complaint ..and I hope and looking forward to get my money back🙏🏿

Thanks for sharing your story. It’s terrible you experienced fraud. Hoping for a swift resolution and the return of your funds!

I experienced the similar issue, hopefully I also get my money back AED 11,000

I have blocked amount 200aed is already deducted to my salary or remain I used

Contact FAB to confirm if the 200 AED is deducted. Blocked amounts are usually temporary holds, but reasons vary. Check your statement for details.

I have 175 dhs blocked amount -222.99 in my balance what shall i do. I recently blocked my card cause i lost it and i also was not able ro maintain minimum balance. Do I need to pay the total negatuve balance before i closed the account. Cause i already found my catd and no need to replace it. I just want to close my account. Do I need to pay all the negatove balance..

Contact your bank to confirm the exact amount owed, including any fees, and settle the negative balance before closing your account. Once cleared, you can close your account without needing a replacement card.

How can I get my deducted money(blocked amount) because I want to closed the account

Hello I have same issue I didn’t used my bank account for too long and I didn’t put extraneous to it now it has blocked amount is it possible to travel without any settlement to my blocked amo

unt?

Traveling without settling a blocked amount on your account can lead to legal issues in the UAE. Banks can report unpaid debts, which may result in travel bans or legal action. It’s advisable to contact the bank, clarify the situation, and resolve the issue before attempting to travel.

i have 175 AED blocked amount and negative -222.99 in my balance same issue

With a blocked amount of 175 AED and a negative balance of -222.99 AED, it’s important to address this quickly. Although the amount is relatively small, unpaid debts in the UAE can still lead to legal consequences like travel bans. Contact your bank to resolve the issue or arrange a payment plan before attempting to travel to avoid any complications.

i have a blocked amount 700, and total of -821 AED, i h ad been unable to mantain my salary and i have left the city. what should i do?? it is exceeding every month.

Contact FAB Bank immediately to explain your situation and discuss a repayment plan. Ignoring the debt may lead to legal action or higher fees. Since you’ve left the city, consult legal advice to understand potential consequences and settle the debt. Handle this as soon as possible to avoid escalation.